Cash Flow Control In Uncertain Markets

Cashflow & Payroll

Jan 4, 2026

Practical cash controls for founder-led agencies protecting payroll: align inflows with outflows, build reserves and use a 13-week forecast to avoid hiring risk.

Your cash flow isn’t just numbers on a spreadsheet - it’s your agency’s ability to survive. If payroll consumes 50–70% of revenue and clients take 60+ days to pay, you’re essentially financing their projects while carrying the risk. This isn’t just stressful - it’s dangerous. Without visibility into cash flow, you’re one unexpected delay away from scrambling to cover the basics.

For founder-led agencies generating $3–10M with payroll-heavy teams, this problem worsens as you scale. Revenue grows, but so do fixed costs. Hiring feels like a gamble. Cash tightens unpredictably. And the gap between what the numbers say and what you can confidently decide widens. The result? Emotional decisions - hiring too soon, cutting too late, or overextending on client terms - turn solvable issues into crises.

This article is about regaining control. You’ll learn how to:

Align inflows with outflows to avoid payroll pressure.

Build reserves that protect against late payments and downturns.

Use a 13-week cash flow model to foresee problems before they escalate.

Link labor productivity to cash flow to stop margin leaks.

The goal is simple: make decisions based on clarity, not chaos. Let’s start with the fixed cost most agencies struggle to manage - payroll.

The Four Forces of Cash Flow: A Framework for Control

Cash Security Framework: Agency Reserve Levels and Risk Assessment

Managing cash flow effectively isn’t about waiting around for payments or making sweeping cost cuts. It’s about taking charge of four key forces - inflows, outflows, timing, and reserves - to ensure you have the cash needed for payroll, growth opportunities, and unexpected delays. While external factors like market downturns or paused projects are beyond your control, you do have power over how quickly you collect payments, how you structure costs, how you align payment schedules, and how you build financial buffers.

Inflows: Speeding Up Client Payments

The quicker you collect payments, the less you’ll need to dip into your own working capital. Leading agencies often invoice 33% upfront to cover early-stage costs like discovery and planning[2]. If you wait until the project wraps up to send an invoice, you’re essentially offering clients free financing while carrying the weight of payroll and other expenses.

Milestone-based billing is a smarter way to maintain steady cash flow. Instead of invoicing 100% upon project completion, break the project into phases tied to specific deliverables. For example, you might request 30% at project kickoff, 30% at the midpoint, and 40% upon completion[4]. This approach ensures a consistent cash inflow instead of a single lump sum that arrives long after your costs are incurred.

Payment terms also matter. Shortening standard terms from 30 days to seven days can set a better baseline for negotiations[2]. If clients insist on longer payment cycles - like 60 or 90 days - some agencies adjust pricing to include financing costs for the extended gap[2].

Automation can make a significant difference here. Tools that schedule invoices and send automatic reminders for overdue payments reduce manual effort. Offering multiple payment options, such as ACH transfers or credit cards, also encourages faster payments. Another effective tactic is pre-chasing invoices: reach out to the client’s accounts payable team shortly after sending the invoice to address any potential delays[2].

While steady inflows are critical, managing your outflows is just as important.

Outflows: Managing Costs Without Sacrificing Quality

Controlling expenses doesn’t mean slashing them across the board. It’s about focusing on essentials - your team, core tools, and project delivery - while identifying areas where spending can be adjusted without hurting quality[1]. This requires distinguishing between fixed costs (like salaries, rent, and necessary software) and variable costs (such as contractor fees or one-off project expenses). Fixed costs demand careful planning, while variable costs offer more flexibility during tight periods[5].

Avoid tying expenses to temporary revenue spikes. If you expand costs based on short-term project surges, you risk overextending and facing tough cutbacks when those projects end[4]. Instead, align your baseline expenses with steady revenue and bring in temporary resources only when absolutely necessary.

Vendor contracts are often more negotiable than they seem. Moving from usage-based billing to flat-fee contracts can make cash flow more predictable. Similarly, spreading large annual costs - like insurance or property taxes - into monthly or quarterly payments can prevent big cash outflows from coinciding with payroll[4][6]. Conducting a quarterly software audit to eliminate unused subscriptions or reduce user counts is another simple way to cut unnecessary costs[4].

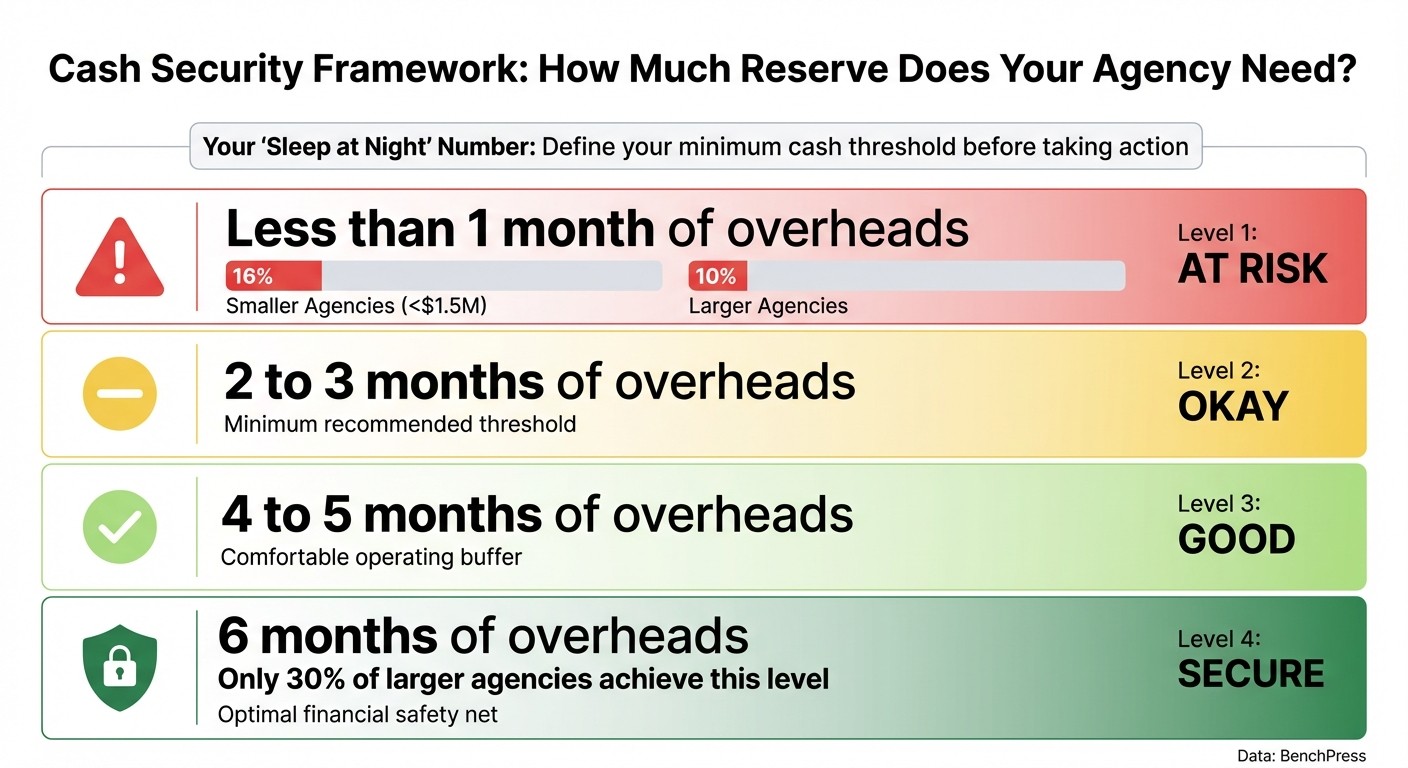

Data from BenchPress reveals that 16% of smaller agencies are "at risk" because they hold less than one month of overhead in reserve. In contrast, only 10% of larger agencies face this issue[2]. Setting a firm minimum - such as three months of overhead in reserve - can act as an early warning system, prompting adjustments before a cash crunch occurs[2].

Timing: Balancing Inflows and Outflows

Even with healthy inflows and controlled outflows, cash flow issues can arise if the timing doesn’t align. For example, if client payments lag behind critical outflows like payroll or taxes, liquidity problems can quickly escalate. The key is to synchronize inflows with your major expenses[6][2].

A 13-week cash flow forecast is an essential tool for identifying timing mismatches early. This forecast allows you to spot periods where cash might be tight and make adjustments before problems arise[1][6]. If certain costs consistently create pressure, consider negotiating with vendors to shift payment dates or spreading annual payments into smaller monthly installments[6][2].

Base your forecast on actual payment behavior. If a client routinely pays in 60 days despite 30-day terms, factor that into your planning[2]. Using milestone-based billing, as discussed earlier, further smooths cash flow by ensuring regular payments throughout a project[4].

One practical habit is a 20-minute weekly cash huddle to review upcoming inflows and outflows. This routine helps catch surprises early, giving you time to chase overdue invoices or request vendor extensions. Prioritizing payments by due dates and interest rates also prevents high-cost debt from eating into your liquidity[1][7].

Reserves: Building a Financial Safety Net

Reserves act as a financial shield against unexpected challenges like late payments, project delays, or unforeseen costs. The BenchPress cash security framework offers a useful benchmark for reserves[2]:

Cash Security Level | Months of Overheads in Bank |

|---|---|

At Risk | Less than 1 month |

Okay | 2 to 3 months |

Good | 4 to 5 months |

Secure | 6 months |

Only 30% of larger agencies maintain six months of overhead in reserves[2], leaving many with limited buffers. If your reserves dip below three months, focus on rebuilding them before the next market disruption.

To build reserves, treat savings as a fixed cost. Allocate a portion of every client payment to a separate account before covering other expenses. This “pay yourself first” strategy, inspired by the Profit First framework, ensures that your reserves grow steadily.

A strong reserve doesn’t just protect your agency during downturns - it also gives you the confidence to make strategic decisions, invest in growth, and be more selective with clients, all without scrambling for cash in a crisis.

These four forces form the foundation for the 13-week cash flow model, which we’ll explore in the next section.

Building a 13-Week Cash Flow Model for Agency Productions

A 13-week cash flow forecast isn’t just another spreadsheet; it’s a practical tool to help you manage short-term liquidity with clarity. By mapping out cash inflows and outflows, you can anticipate when things might get tight and adjust before payroll or vendor payments become a crisis. For agencies juggling milestone-based billing cycles and fluctuating contractor costs, this shifts cash management from reactive problem-solving to proactive planning.

How to Build the 13-Week Cash Flow Model

Start with your current bank balance as the foundation. From there, estimate your weekly inflows and outflows for the next 13 weeks.

Inflows: Include payments from retainers, project milestones, and confirmed new work. Base your estimates on actual payment behaviors, not just invoice due dates[1][2].

Outflows: Account for recurring costs like payroll, rent, and subscriptions, alongside variable expenses such as contractor fees, media buys, and project-specific costs. Prioritize these outflows: operating expenses and payroll come first, followed by taxes, debt payments, cash reserves, and finally owner distributions[1].

Calculate your weekly rolling balance: Previous Balance + Inflows – Outflows[3].

Keep the forecast accurate by dedicating 20 minutes each week to a cash huddle. Update actual numbers and tweak projections as needed[1]. For this to work, your accounting data must be current - forecasts based on outdated figures are useless[1].

Once the basics are in place, strengthen your model by incorporating scenario planning.

Using Scenario Planning for Better Decisions

A single forecast assumes everything will go smoothly - but that’s rarely the case. To prepare for uncertainty, build three versions of your 13-week model:

Best Case: On-time payments and seamless project delivery.

Base Case: Minor delays and a few late-paying clients.

Worst Case: Significant revenue drops, delayed payments, and postponed projects[2][5].

Review these scenarios during your weekly cash huddle. If the worst-case model shows your cash dipping below your minimum threshold - say, two months of operating expenses - it’s a signal to act. This might mean chasing overdue invoices, negotiating payment terms with vendors, or cutting back on discretionary spending[1][2].

As Michael Argento aptly puts it:

"The power of a 13-week cash flow isn't the spreadsheet - it's the rhythm."[1]

Connecting Labor Productivity to Cash Flow Discipline

For payroll-heavy agencies, labor is both your greatest asset and your largest expense. Payroll typically consumes 75% to 85% of total costs, meaning every unproductive hour or unchecked scope creep directly chips away at your cash reserves [8]. In uncertain markets, relying on guesswork to gauge team productivity isn’t an option. You need clear, actionable data on utilization and its impact on cash flow. This level of visibility doesn’t just help you manage day-to-day operations - it enhances your cash flow discipline by exposing the financial consequences of idle time or overcommitted resources. When paired with a 13-week cash flow forecast, linking labor utilization to cash metrics gives you a sharper view of how operational efficiency affects liquidity.

Tracking Utilization to Manage Payroll Risk

Utilization metrics are critical for understanding whether your team is generating revenue or simply draining cash. When utilization drops, you’re paying full salaries for partial output, accelerating cash burn. On the flip side, chronic overutilization can indicate underpricing, burnout, or scope creep - all of which erode margins and cash reserves [9].

Start by measuring billable hours against total available hours for each team member. Inefficient processes often eat into billable capacity. Daniel Dye, President of Native Rank, Inc., shared this insight:

"By streamlining our reporting process and freeing up more billable time, we have been able to take on more clients and expand our service offerings" [9].

Regular audits of timekeeping versus payroll data can also uncover hidden inefficiencies. In labor-intensive industries, unplanned overtime often goes unnoticed without frequent reviews, leading to significant excess costs. For instance, payroll mistakes are more common than you might think - 42% of employees who experienced payroll errors reported missing or incorrect overtime pay [10]. Cross-referencing your time tracking system with payroll records ensures you’re not hemorrhaging cash due to unnoticed overages.

Integrating Productivity Metrics into Cash Flow Forecasts

To refine your 13-week cash flow forecast, incorporate real-time productivity data. Instead of tying revenue projections solely to invoice dates, align them with delivery milestones. For example, if your team completes 30% of a project in one week, consider invoicing for 30% of the project’s total value [4].

Differentiate between fixed salaries and variable contractor costs in your forecast. Fixed payroll represents a consistent outflow, while contractor expenses shift based on project demand [5]. If utilization data shows your team nearing full capacity and a new project looms, you’ll have the data to evaluate whether additional resources are needed - and at what cost - before making commitments.

Weekly cash reviews should also incorporate productivity metrics. If a project starts exceeding its original hour estimate, pause to renegotiate fees before ballooning labor costs eat into your margins [9]. As Ryan Kelly, CEO of Pear Analytics, cautions:

"Agencies can lose a significant amount of recurring revenue in a recession and have a difficult time scaling down labor costs. So you're faced with letting team members go to maintain margin or eat into your reserves" [9].

Making Safer Financial Decisions in Uncertain Times

When uncertainty looms, clear, data-driven decisions become essential. Relying on instinct or outdated assumptions in volatile markets can expose your agency to unnecessary risks. Instead, establish financial guardrails that dictate when to act and when to hold back, preserving cash reserves. These guardrails, rooted in the Four Forces of Cash Flow, help translate cash insights into practical hiring and pricing strategies.

Financial Guardrails for Hiring During Volatility

Hiring decisions should never jeopardize your cash reserves. Set a minimum cash reserve threshold - an amount your business will not dip below. For instance, The Wow Company shared a case where an agency owner identified their "sleep at night" number as three months of operating expenses. When reserves approached that limit, they took proactive steps, including redundancies, to maintain financial security[2].

Before hiring, stress-test your decision using a 13-week cash flow forecast. Evaluate optimistic, base, and pessimistic scenarios to confirm your reserves stay above the three-month threshold, even in the worst case. If the forecast reveals a tight cash week within this period, delay the hire until you achieve a sustained surplus[1]. Michael Argento, CPA and Founder of Argento CPA, emphasizes:

"A two-month cushion of operating expenses... gives you freedom to handle downturns or take risks without sleepless nights"[1].

Monitor cash reserves using tiered security levels: At Risk (less than 1 month of overhead), Okay (2–3 months), Good (4–5 months), and Secure (6 months). Data shows that 16% of agencies earning under $1.5 million operate with less than one month of overhead, compared to just 10% of larger agencies[2]. Prioritize cash allocation as follows: operating expenses for your current team, taxes, debt payments, and cash reserves. Growth-related hiring should only occur after these obligations are met[1]. A 20-minute weekly cash review with your finance lead can ensure spending remains focused on essentials during uncertain times[1].

Pricing Strategies to Protect Margins

Pricing discipline is another key to safeguarding your margins during market volatility. If clients request extended payment terms, such as 60 or 90 days, include a financing cost to cover the interest on additional funding required to pay your team during the delay[2]. As The Wow Company advises:

"A built-in financing cost would cover the interest on any additional funding"[2].

This isn't a penalty - it’s a practical adjustment to account for cash flow risk.

To maintain liquidity, consider phased payment structures for projects. Instead of invoicing a lump sum at the project’s end, adopt a model like 30% upfront, 30% at the midpoint, and 40% upon completion[4]. Top-performing agencies often invoice an average of 33% upfront[2], accelerating cash inflows and reducing the risk of late payments disrupting payroll.

Set standard payment terms to seven days, which positions you to negotiate from a place of strength. Even if larger clients push back, starting with shorter terms emphasizes the importance of timely payment and gives you leverage to adjust pricing if necessary. Implement late payment protocols that pause work after 14 days of non-payment, and actively engage with clients' accounts payable teams to ensure invoices are processed promptly[2].

For revenue stability, aim for a 70:30 split between retainer-based and project-based income[4]. Retainers provide predictable cash flow, simplifying forecasting and reducing the uncertainty of project-only models. Offering tiered retainer pricing (e.g., Basic, Standard, Premium) can give clients flexibility while protecting your margins[4]. Additionally, enforce strict scope management by tying every task outside the original agreement to additional fees. One creative agency improved project profitability by over 20% after introducing real-time reporting and automated invoicing to catch scope creep early[4].

Conclusion: Regaining Control and Reducing Downside Risk

Uncertain markets highlight just how vulnerable agencies can be without disciplined cash flow management. Tools like the Four Forces of Cash Flow, the 13-week forecast, and labor productivity metrics aren’t just theoretical - they’re practical systems designed to limit downside risk and enable quicker, more informed decisions during unpredictable times.

The 13-week cash flow model is indispensable for identifying payroll shortfalls, tax deadlines, and upcoming vendor payments clearly and in advance[1][6]. Pair this with a quick, 20-minute weekly cash huddle to confirm inflows, outflows, and net balances before making payment decisions[1]. This routine transforms cash management from a reactive scramble into a proactive, controlled process.

Establish a financial safeguard by defining a "line in the sand" - a minimum cash balance, typically equivalent to two or three months of expenses. When this threshold is breached, it should automatically trigger measures like cutting costs, delaying hires, or pausing owner distributions[1][2]. Having this predefined plan prevents hasty, emotional decisions when cash gets tight.

When allocating cash, follow this order of priorities: operating expenses for your team, taxes, debt payments, cash reserves, and finally, owner distributions[1]. This sequence ensures the business remains stable and avoids the pitfall of funding growth at the expense of financial health. Strengthen your receivables process by implementing seven-day payment terms, requiring 33% upfront invoicing, and using automated reminders[2][6]. Additionally, aim for a revenue mix of 70% retainers and 30% project-based work to create more predictable monthly cash inflows[4].

These steps aren’t just about surviving tough markets - they’re about creating a framework that ensures long-term financial stability and control.

FAQs

What are the best ways for agencies to get clients to pay faster and improve cash flow?

To keep cash flow steady, agencies can adopt a few practical tactics to encourage quicker client payments. Start by requiring upfront deposits or setting up milestone payments to bring in cash early during a project. Contracts should outline short payment terms - think net 15 or net 30 days - and invoices should be sent immediately upon completing tasks or reaching milestones.

Leverage automated reminders to follow up on overdue invoices, keeping the process consistent and efficient. For larger projects, installment plans can make payments easier for clients, while offering early payment discounts or applying late payment penalties (like interest fees) can further incentivize timely payments. These measures create clear expectations and minimize delays, helping to maintain a healthier cash flow.

How can I manage fixed and variable costs effectively without compromising quality?

To control costs without compromising service quality, prioritize data-driven budgeting by setting spending limits tied to specific KPIs. Reassess fixed contracts to ensure they match your current requirements, and boost labor efficiency by monitoring and refining utilization rates. Adopt a profit-first approach to cash management, allocating profits deliberately, and perform regular cash flow forecasts to match variable expenses with revenue patterns. These methods allow you to remain adaptable while delivering consistent results, even in volatile markets.

How does a 13-week cash flow model help agencies stay financially stable?

A 13-week cash flow model offers agency founders a detailed, week-by-week breakdown of their financial outlook for the next three months. This level of clarity allows you to spot potential cash gaps, anticipate delays in client payments, and prioritize essential expenses like payroll, taxes, and vendor obligations.

With this foresight, you can make calculated decisions about leveraging credit lines, timing investments, or trimming expenses. This kind of forward planning is critical for maintaining financial stability, particularly during unpredictable market conditions.

Related Blog Posts

More Free Tools & Templates

For now, start where every serious founder does — with control.

© STEALTHCFO 2025 | TERMS & PRIVACY