Fractional CFO Role In Financial Due Diligence

Financial Control

Jan 1, 2026

Fractional CFOs turn agency books into transaction-ready controls, exposing payroll risk, hidden liabilities and cashflow gaps so founders decide with confidence.

If your agency’s financial records can’t hold up to scrutiny, your growth, funding, or exit plans are at risk. Most founder-led B2B agencies operating in the $3–10M range rely on basic bookkeeping, but that’s not enough when the stakes are high. Buyers, investors, and lenders don’t just glance at the numbers - they interrogate them. They’ll question your margins, cash flow, and liabilities. If your financials fail to answer, deals fall apart - or valuations drop.

This isn’t just about compliance or clean books. It’s about control. At this stage, payroll is your biggest expense, margins feel tight, and cash flow doesn’t always match revenue. Hiring feels risky because you’re unsure how it impacts profitability. The numbers exist, but they don’t help you make confident decisions. That’s where the gap lies: between accounting and financial intelligence.

A fractional CFO bridges that gap. They transform your financials into decision-ready tools, ensuring your numbers can withstand scrutiny while giving you clarity to scale. In this article, we’ll break down how they do it, including:

Verifying revenue and profitability to reflect reality, not assumptions.

Identifying hidden risks in your balance sheet that could derail deals.

Preparing transaction-ready financials that build trust with buyers and investors.

If you’re scaling, hiring, or preparing for a transaction, this is the clarity you need. Let’s start with why accurate financial records are non-negotiable.

Financial Due Diligence Statistics and Key Metrics for B2B Agencies

Why Accurate Financial Records Matter in Agency Due Diligence

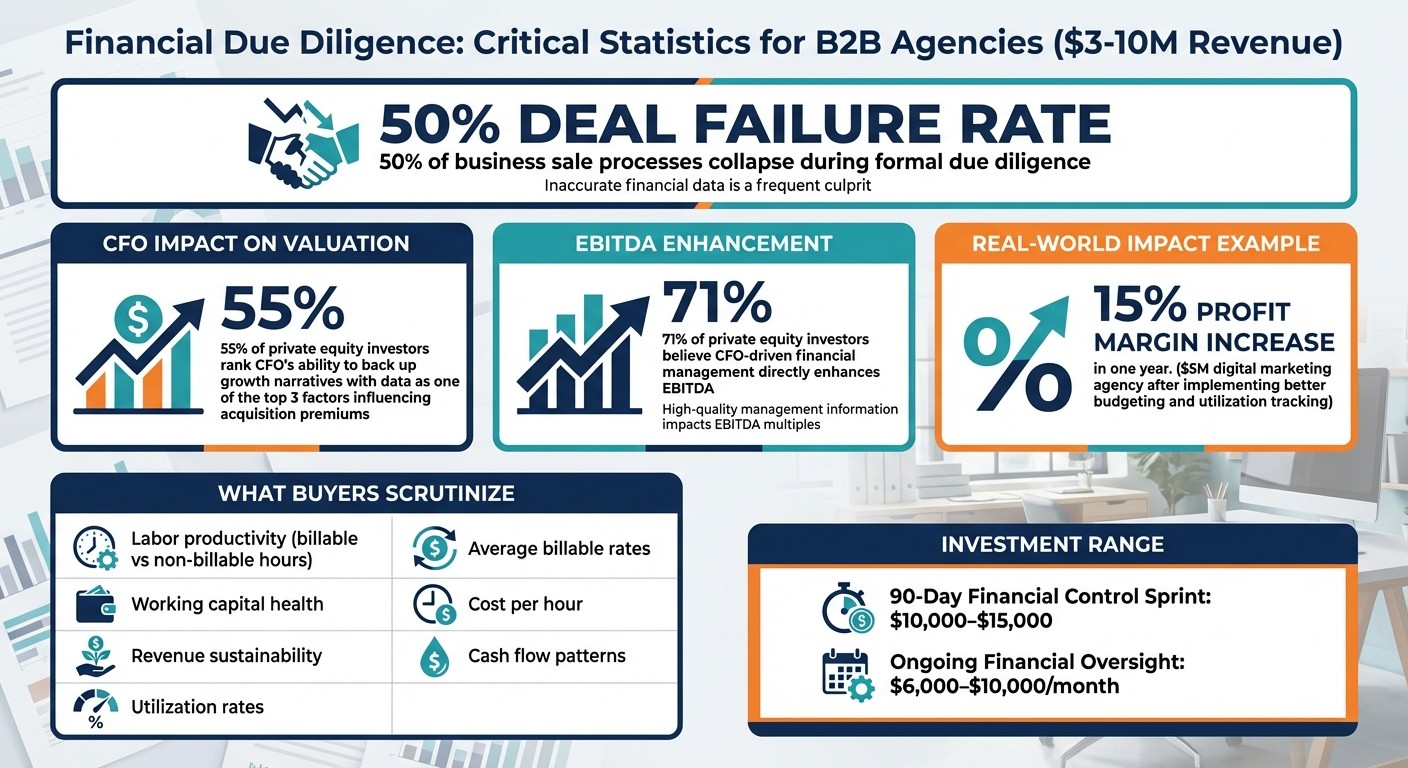

For agencies, payroll is often the largest expense, making it critical to understand its impact on labor costs and project profitability. When financial records are incomplete, it’s nearly impossible to gauge whether your margins are solid or if revenue is simply masking cash flow issues. This lack of clarity can be disastrous - around 50% of business sale processes collapse during formal due diligence[5], with inaccurate financial data being a frequent culprit.

Reliable financial records do more than just safeguard transactions; they enable better decision-making. If your reports can’t clearly show whether a new hire will strengthen margins or drain cash, you’re essentially making decisions in the dark. This uncertainty forces potential buyers to investigate your operational metrics more closely, which can stall or derail deals.

What Buyers and Investors Look For

A skilled fractional CFO can turn ambiguous financials into actionable insights. Buyers and investors typically focus on several critical metrics, including:

Labor productivity: Are your employees effectively contributing to revenue?

Working capital health: Can your agency manage short-term obligations without strain?

Revenue sustainability: How stable and predictable is your income stream?

Buyers also assess utilization rates, comparing billable hours to non-billable ones to determine efficiency and identify unused capacity. Pricing models come under scrutiny, with average billable rates and cost per hour analyzed to ensure profitability. Additionally, cash flow patterns are reviewed to confirm whether the agency can consistently meet payroll, even during slower periods.

Private equity investors, in particular, value financial transparency. According to one study, 55% of private equity investors rank a CFO’s ability to back up growth narratives with data as one of the top three factors influencing acquisition premiums[5]. If your financials can’t prove that your agency delivers predictable margins and cash flow, buyers may lower their valuation - or walk away entirely.

The Cost of Untrustworthy Numbers

Unreliable financial data doesn’t just hurt your credibility with buyers; it also weakens your ability to make informed decisions internally. Discrepancies like misreported revenue or inconsistent margin calculations can instantly erode trust. As Ascent CFO aptly put it, “Time kills all deals.”[5] Delays caused by incomplete or inaccurate records give buyers time to second-guess, renegotiate, or abandon the process altogether.

Internally, the impact of poor financial records is just as damaging. Without accurate data, you’re left reacting to problems instead of planning confidently. For instance, one digital marketing agency generating $5 million annually increased its profit margins by 15% in a single year after implementing better budgeting and employee utilization tracking[4]. This example highlights how financial clarity not only prepares you for due diligence but also drives profitability and operational efficiency.

How Fractional CFOs Verify Revenue and Profitability

Revenue Recognition in Service Businesses

Fractional CFOs bring rigor to the process of verifying revenue and profitability, ensuring your financials stand up under scrutiny during transactions.

They start by mapping the flow of revenue - from contract signing to cash collection - by examining critical accounts to understand how money moves through your agency [6]. This isn't just about ticking compliance boxes; it's about ensuring revenue reflects what has truly been earned, not skewed by timing issues. For example, they carefully check for premature revenue recognition, where income is recorded before it’s fully earned. They also separate recurring retainer income from one-off project fees to prevent inflated revenue forecasts [1][2].

Another area of focus is identifying inconsistencies in financial patterns. If General Ledger codes remain static in a business that should show variability, or if revenue patterns don’t align with operational activity, it raises questions [6]. These details can reveal irregularities often overlooked in standard reporting. For businesses with irregular billing cycles, fractional CFOs create tailored cash flow strategies to manage fluctuating payment schedules [3]. They also evaluate client concentration risk. If too much revenue depends on a small number of clients, potential buyers may discount your valuation - or walk away entirely.

Confirming True Profitability

Verifying profitability goes beyond surface-level numbers; fractional CFOs dig deeper to uncover the real story behind reported profits.

One common adjustment involves normalizing owner compensation. Many agencies report profits without accounting for owner pay at market rates, which can distort the true profitability of the business. Fractional CFOs restructure Profit and Loss statements to include this adjustment, providing a clearer picture of operational performance. They also analyze three critical factors driving agency margins: the average billable rate, the utilization rate, and the average cost per hour [3]. If billable rates lag behind rising labor costs or if utilization rates are low, the reported profit may not reflect the actual health of the business.

In addition, they conduct a multi-year review of expenses - typically covering three to five years - to spot unusual patterns, hidden liabilities, or unnecessary overhead that might artificially inflate margins [1]. A 2015 Deloitte survey found that 71% of private equity investors believe CFO-driven financial management directly enhances EBITDA [5]. Without this level of detailed analysis, you risk presenting numbers that could crumble under due diligence.

Reviewing Balance Sheet Accuracy and Hidden Risks

Balance Sheet Accounts That Matter Most

Fractional CFOs zero in on specific balance sheet accounts that directly influence working capital and, by extension, the overall transaction value.

Accounts Receivable (AR) is a key focus, particularly the aging schedule, with attention to receivables over 90 days past due. This helps verify revenue collection patterns and spot payment issues [7]. If a significant portion of AR turns out to be uncollectable, reported earnings may not align with the actual economic performance. Deferred Revenue is equally important for service-based businesses. If customer prepayments aren’t properly recorded as deferred revenue, it can result in overstated revenues and understated liabilities, artificially inflating the company’s valuation [8]. Similarly, reviewing Accounts Payable aging can reveal vendor disputes or historical payment delays that affect working capital calculations [7].

Accrued Liabilities often hide obligations like unpaid vacation, commissions, or bonuses, which can distort EBITDA [7][8]. These omissions not only lower EBITDA but also skew working capital targets. To address this, the working capital formula - (Accounts Receivable + Inventory) minus (Accounts Payable + Accrued Expenses) - should be adjusted to account for deferred revenue and customer deposits, ensuring a more accurate baseline [8].

Once these critical accounts are examined, fractional CFOs dig deeper to uncover liabilities that may not be immediately visible on the balance sheet.

Finding Hidden Liabilities

Hidden risks often lurk in contracts, compliance reports, and loan agreements, presenting challenges that can cloud financial transparency.

Fractional CFOs meticulously review contracts, debt agreements, and compliance documents to uncover obligations that aren’t readily apparent. For example, compliance reports might reveal off-balance-sheet regulatory liabilities. Agencies, in particular, face risks like pending litigation, unrecorded employee benefits, or other regulatory exposures that don’t show up on the balance sheet.

Debt agreements are another area of focus, especially for clauses tied to change-of-control events or covenant breaches that could trigger immediate repayment demands [7]. Related party accounts - such as loans or receivables involving owners or affiliates - must also be carefully identified and adjusted to present the business as a stand-alone entity [7]. Without this level of scrutiny, there’s a risk of presenting an inaccurate balance sheet that could unravel under buyer review or lead to post-transaction surprises that erode deal proceeds.

This thorough examination provides agency founders with the financial clarity they need to confidently navigate high-stakes transactions, avoiding unpleasant surprises and ensuring sound decision-making.

Preparing Transaction-Ready Financial Documentation

Once your numbers are verified, fractional CFOs focus on creating financial documentation that instills confidence in potential buyers.

Cleaning Historical Financials

The process begins with a detailed general ledger (GL) review, ensuring consistent monthly booking practices and accounting policies [6]. This step identifies anomalies - such as costs or revenues that remain static when they should fluctuate - highlighting potential errors or inconsistencies. The aim is straightforward: align costs and revenues accurately across periods, eliminating confusion before a buyer's review even starts.

Restating historical financials is another critical step. This involves aligning recognized revenue with service delivery and properly capitalizing long-term costs [2]. Fractional CFOs also restructure the profit and loss (P&L) statement to clearly distinguish between variable and fixed costs, providing a sharper view of unit economics [6]. Additionally, they formalize any unwritten accounting policies, ensuring the finance team operates transparently and can withstand the scrutiny of potential buyers [6]. These efforts significantly reduce the risk of unexpected financial discrepancies during due diligence - a stage where nearly 50% of business sale processes falter [5]. With restated and clarified records, fractional CFOs streamline communication with buyers, setting the stage for smoother negotiations.

Supporting Buyers During the Process

Once internal financial clarity is achieved, the focus shifts to presenting these meticulously prepared records to buyers. Fractional CFOs take on the role of primary financial liaison, addressing technical questions, explaining historical variances, and filtering out unqualified bidders [5]. They also organize and populate digital data rooms with audit-ready information, including financial analyses and five years of historical metrics. Simultaneously, they build and defend three-year financial models - covering the P&L, Balance Sheet, and Cash Flow - rooted in evidence-based assumptions that align with the company's growth story [5][2].

Ascent CFO highlights the importance of this preparation:

"Every business goes through difficult periods, but if your CFO can explain why the company missed an internal target, how the company got back on track, and what procedures mitigate exposure to the same or similar events in the future, it will build, rather than deteriorate confidence in the fundraising process." [5]

For agencies, this means showcasing a disciplined approach to labor productivity, clear utilization rates, and steady cash flow despite payroll-heavy cost structures. Fractional CFOs ensure buyers see more than just clean financials - they see a business with solid financial controls and operational clarity. This reduces surprises, maintains deal momentum, and builds trust, all the way through to closing.

The StealthCFO Approach to Financial Due Diligence

The StealthCFO method goes beyond producing reports; it builds financial discipline that can handle the scrutiny of potential buyers while enabling confident, transaction-ready decisions. For agency founders, even accurate reports often fall short of providing the kind of clarity needed for high-stakes moves. StealthCFO bridges this gap by installing financial controls that ensure your business operates with precision and transparency.

At its core, this approach transforms standard financial reporting into a system of disciplined control. The 90-Day Financial Control Sprint focuses on three key areas:

Labor Productivity Discipline: Breaks down margin drivers - average billable rate, utilization rate, and average cost per hour. This analysis pinpoints inefficiencies, identifying whether profits are being left on the table or if the business is operationally active but cash-constrained.

Cash Flow Control: Implements the Four Forces of Cash Flow framework to smooth out the unpredictable billing cycles common in project-based businesses. This ensures liquidity remains steady, even under the scrutiny of buyers evaluating working capital.

Forecasting Frameworks: Replaces static budgets with dynamic revenue projections informed by actual project pipelines and scenario modeling. This gives buyers confidence in a growth narrative rooted in real operational data.

This structured approach delivers a level of clarity that traditional accounting often misses. It distinguishes between recurring and one-time income, verifies true profitability after factoring in owner compensation, and uncovers hidden liabilities that could derail a deal. The result? A business that doesn’t just pass financial due diligence - it demonstrates control, minimizes surprises, and keeps deals moving toward a close.

For agencies with revenues between $3 million and $10 million, the Sprint is typically a $10,000 to $15,000 investment. This upfront cost mitigates risks like hiring errors, stalled deals, or valuation reductions. Afterward, ongoing financial oversight - priced between $6,000 and $10,000 per month - maintains and builds on these controls, ensuring your business stays prepared as it scales.

Conclusion

Thorough due diligence exposes any financial vulnerabilities. For founder-led B2B agencies generating between $3 million and $10 million in revenue, the success or failure of a transaction often hinges on one critical element: whether your financial records can endure scrutiny without sparking renegotiations or outright termination. Half of all sales processes collapse during formal due diligence, often due to late-discovered material issues or inconsistencies in the financials [5].

A fractional CFO brings the financial rigor required to navigate high-stakes decisions. With 71% of private equity investors stating that high-quality management information directly impacts EBITDA multiples [5], the cost of poor financial oversight becomes impossible to ignore.

Beyond strong financial controls, actionable preparation is essential. Start by implementing weekly reporting on cash flow, accounts receivable, and accounts payable to maintain a clear view of liquidity. Standardize and document your accounting policies to eliminate ambiguities in how revenue and costs are recognized. Most critically, ensure your historical financials - covering at least three to five years - are accurate, reconciled, and backed by evidence that can withstand a buyer’s scrutiny [1].

For agencies with solid bookkeeping but facing critical decisions around hiring, cash flow, or scaling, StealthCFO's 90-Day Financial Control Sprint turns your financial reporting into a tool for transaction-ready clarity. The outcome? A business that doesn’t just survive due diligence but demonstrates control, avoids surprises, and keeps deals progressing toward closure.

Strong financial control is essential at every stage of growth. It safeguards valuation, preserves your options, and enables sound, evidence-based decisions. When the stakes are high, your financials must be more than compliant - they need to be ready to drive decisions.

FAQs

How can a fractional CFO support financial due diligence?

A fractional CFO offers seasoned financial oversight during the due diligence process, ensuring your financial records are precise, dependable, and prepared for critical decision-making. They uncover potential risks, such as cash flow issues or hidden liabilities, and provide clear, actionable insights to inform your next moves.

By delivering this expertise without the expense of a full-time CFO, fractional CFOs equip agency founders with the clarity and confidence needed to make smarter, faster decisions during high-stakes financial assessments.

How does a fractional CFO ensure financial records are accurate during due diligence?

A fractional CFO plays a crucial role in ensuring financial accuracy during due diligence. They meticulously review essential financial documents like balance sheets, income statements, and cash flow statements. By identifying discrepancies, reconciling accounts, and analyzing detailed entries, they ensure the financial data is precise and ready for decision-making.

Through the implementation of well-defined financial controls and the enforcement of consistent accounting practices, they help businesses address hidden risks, correct errors such as misclassified entries, and deliver dependable financial reports. This detailed approach minimizes uncertainty and equips founders with the clarity needed to make sound decisions during pivotal moments.

What financial metrics are most important to buyers and investors during due diligence?

During due diligence, buyers and investors zero in on critical financial metrics that paint a clear picture of your business's performance and potential. These typically include profit margins, cash flow patterns, revenue growth, and labor efficiency. They also scrutinize the accuracy and reliability of your financial records to confirm they’re ready for informed decision-making.

Engaging a fractional CFO can be a game-changer here. For founder-led B2B agencies, they help refine your financial data to ensure it’s precise, transparent, and aligned with what investors expect. This reduces decision-making risks and positions your agency as financially disciplined and primed for growth.

Related Blog Posts

More Free Tools & Templates

For now, start where every serious founder does — with control.

© STEALTHCFO 2025 | TERMS & PRIVACY