How IP Impacts Creative Agency Sales

Cashflow & Payroll

Jan 7, 2026

Owning and documenting IP turns payroll-heavy agencies into asset-driven businesses, reducing founder risk, stabilizing cash flow and increasing sale multiples.

Your intellectual property (IP) isn’t just an asset - it’s the difference between selling a job and selling a business. If your agency is built entirely on billable hours and payroll, your valuation will reflect that. Buyers don’t pay premiums for risk-heavy, founder-dependent service models. They pay for systems, assets, and predictable revenue streams. That’s where IP comes in.

For founder-led agencies generating $3–10M in revenue, IP is the lever that shifts your business from labor-driven to asset-driven. Without it, you’re selling relationships and hours. With it, you’re selling scalable systems and defensible revenue. It’s the difference between a standard EBITDA multiple and a premium valuation.

Here’s why this matters: as your agency grows, payroll becomes your largest fixed cost, and client churn exposes you to constant financial pressure. Buyers know this, which is why they’ll scrutinize how much risk they’re inheriting. IP changes the equation. It reduces founder dependency, stabilizes cash flow, and creates a competitive moat - all of which drive higher multiples.

In this article, we’ll show you:

Why buyers value IP as a revenue engine, not just an asset.

The types of IP that matter most for agency sales.

How to document and protect your IP to avoid deal-breaking risks.

Valuation methods buyers use to price IP and what they’ll expect from you.

If you’re serious about selling your agency, you need to treat your IP like the asset it is. Here’s how to start.

How IP Affects Creative Agency Valuation

When buyers assess an agency's value, they prioritize reducing risk alongside EBITDA. Agencies with well-documented and defensible intellectual property (IP) portfolios tend to command significantly higher sale multiples - often 2–5x more than agencies reliant solely on service-based revenue streams [3]. Why? Because IP provides predictable income, reduces reliance on the founder, and creates a competitive moat that’s tough for competitors to breach.

How Buyers View IP as a Revenue Stream

Buyers see IP as more than just an asset - it’s a revenue engine. Licensing agreements, royalty income, and white-label products generate steady, scalable revenue that doesn’t depend on employee headcount. This shifts the agency away from a labor-intensive service model toward an asset-driven business with more scalable economics. Importantly, registering IP under the agency itself - rather than under individuals - helps avoid post-sale legal headaches.

Take the 1998 Rolls-Royce acquisition as a cautionary tale. Volkswagen paid £430 million for the factory and the iconic "Spirit of Ecstasy" mascot. However, they overlooked securing the brand name and logo, which were owned by Rolls-Royce plc. BMW later paid Rolls-Royce plc £40 million for the brand rights, forcing Volkswagen to phase out the Rolls-Royce name after a four-year transition [3]. The takeaway? Owning the right IP can matter far more than owning physical assets.

This kind of revenue predictability gives buyers confidence, which directly translates into higher sale multiples.

Why IP Drives Higher Sale Multiples

Defensible IP doesn’t just stabilize revenue; it also strengthens competitive positioning. Proprietary tools, automated processes, and documented methodologies reduce reliance on the founder, addressing one of the biggest risks in agency acquisitions. IP-based revenue - such as licensing fees or automated tools - offers scalability without the proportional increase in labor costs that service-based models require. This makes the agency not only more attractive but also easier to scale post-sale.

For founder-led agencies, the message is straightforward: if you want to secure a premium valuation, you need to own, protect, and monetize your IP before entering sale discussions. It’s not just about having IP - it’s about making it a core, revenue-generating asset.

Types of IP That Impact Agency Sales

When it comes to agency valuation, buyers consistently focus on three key types of intellectual property (IP): patents, trademarks, and copyrights. Each plays a unique role in safeguarding your agency's assets and enhancing its market value.

Patents: Securing Tools and Processes

Patents offer exclusive rights to proprietary technologies, software systems, and innovative processes for up to 20 years [4]. For creative agencies, this might include custom-built tools, automated workflows, or groundbreaking technical solutions - essentially, anything that competitors can’t easily duplicate. This exclusivity can lead to higher profit margins and a stronger valuation [4].

That said, obtaining a patent isn’t simple. The application process is formal, time-consuming, and often expensive [4]. However, for agencies that have developed unique technologies - like proprietary analytics platforms, automated campaign tools, or specialized software systems - the investment can be worthwhile. Agencies with patent portfolios often see better outcomes during acquisitions, as evidenced by higher public market success rates for startups with patents [3].

Trademarks: Strengthening Brand Identity

Trademarks protect the elements that define your agency's brand: its name, logo, slogan, and even distinctive color schemes [4][2]. Unlike patents, trademarks can last indefinitely, as long as renewal fees are paid every 10 years [4]. This makes them a durable asset that builds goodwill and cements your market position over time.

For buyers, trademarks go beyond securing your client list - they help establish your agency’s presence in the market. Properly registered trademarks demonstrate that your brand is well-positioned, which can translate into stronger revenue potential.

However, trademark applications can take 12–18 months to process. If you're considering selling your agency, filing early ensures this asset is in place when it matters most [4].

Copyrights: Leveraging Creative Assets

Copyrights protect original creative works such as website designs, source code, ad campaigns, training materials, and other content [4][2]. Unlike patents, copyright protection is automatic upon creation and lasts for the creator’s lifetime plus 70 years [4]. This makes it the most accessible form of IP for most agencies.

The real power of copyrights lies in their potential for ongoing revenue. Agencies can monetize copyrighted materials through licensing, white-label products, royalty agreements, or syndicated content. Sharon Toerek, Founder of Legal+Creative, emphasizes this point:

"Some of your best leverage in your agency's client relationships is the intellectual property you create for them" [1].

However, there’s a catch: if freelancers produce creative work for your agency, you need explicit agreements transferring ownership of the IP to your agency. Without these contracts, you may not legally own the assets you intend to sell. This oversight is a common pitfall during due diligence and can derail deals quickly [5].

IP Valuation Methods for Agency Sales

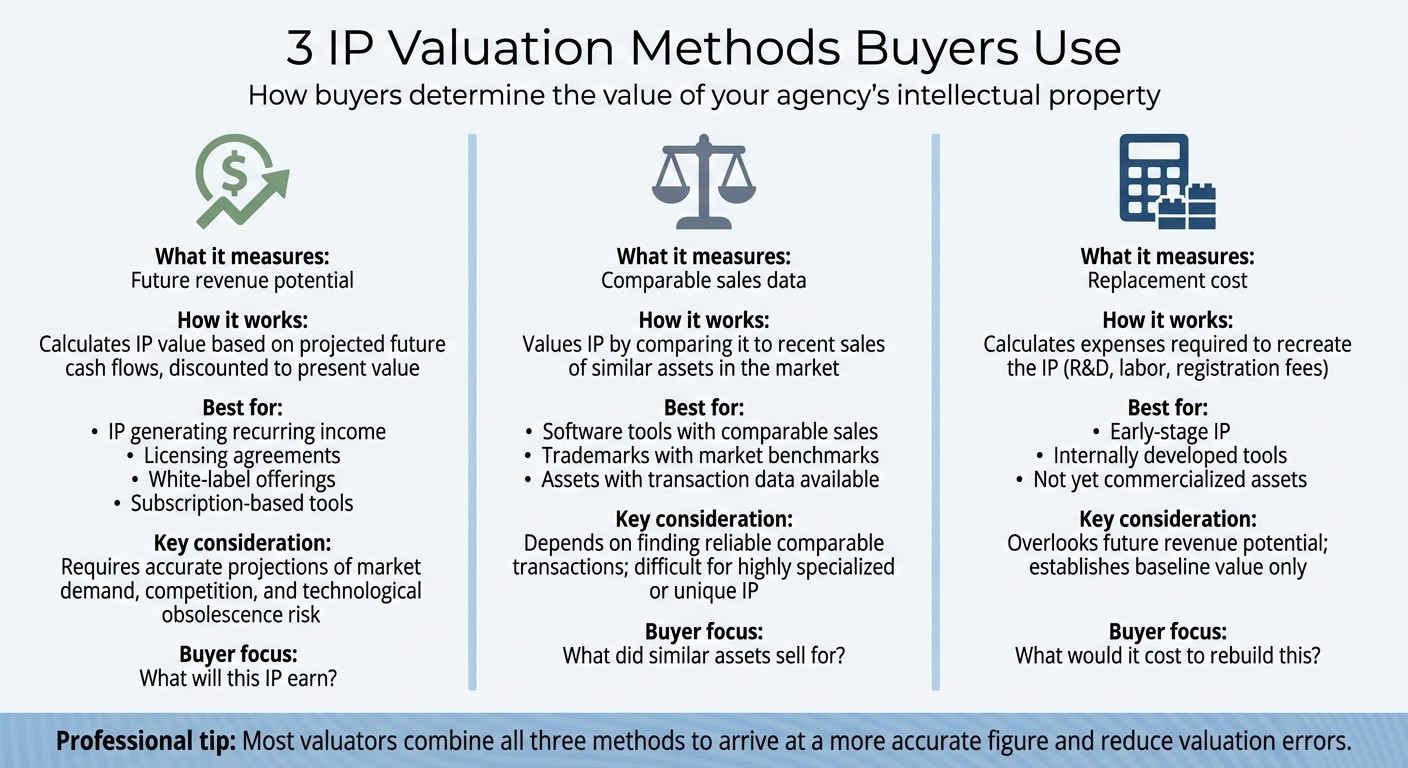

Three IP Valuation Methods for Agency Sales Comparison

When buyers evaluate your agency's intellectual property (IP), they need a clear and precise valuation. Three primary methods dominate this process, each tailored to different stages of IP maturity and commercial application.

The income approach calculates your IP's value based on its future revenue potential, discounting those cash flows to their present value. This method is particularly effective if your IP generates recurring income. For instance, licensing a proprietary tool or earning steady fees from white-label offerings fits well within this framework. However, it comes with challenges - projections must be accurate, and buyers will closely examine your assumptions about market demand, competition, and the risk of technological obsolescence [8][9].

The market approach values your IP by comparing it to recent sales of similar assets. For example, if another agency sold a comparable software tool or trademark, that transaction can serve as a benchmark. This approach is grounded in current market conditions and provides an objective reference point. The downside? It depends heavily on finding comparable transactions. If your IP is highly specialized or unique, reliable data points may be scarce [8][7].

The cost approach focuses on the expenses required to recreate the IP, factoring in costs like research, development, labor, and registration fees. This method is most applicable to early-stage IP - such as tools developed internally but not yet commercialized - by establishing a baseline value tied to sunk costs. However, it overlooks the potential for future revenue. Buyers typically care more about what an asset will earn rather than what it cost to create [8][9].

In practice, most professional valuators combine these methods to arrive at a more accurate figure, reducing the risk of valuation errors [8]. The right approach depends on your IP's revenue generation, the availability of comparable sales data, and the asset's maturity. These methods help clarify when IP holds the most value and highlight the risks of leaving it unprotected.

Timing and Risks of IP in Agency Sales

When IP Delivers Maximum Value

Intellectual property (IP) plays a pivotal role in maximizing agency sale value, but its impact depends on being mature, monetized, and well-documented before the sale process begins. Buyers are willing to pay significant premiums when your IP reduces their risk and accelerates their ability to generate revenue. To achieve this, ensure patents are issued, trademarks are registered and enforced, and copyrights and trade secrets are thoroughly documented and monetized.

Data underscores the importance of IP: companies with patents see median exit values that are 154.9% higher, with price premiums reaching up to 34% [10][11]. However, these outcomes don’t happen overnight. If you’re targeting an exit within the next 12–18 months, consider expedited USPTO programs like Track One, which can reduce the patent approval timeline to 12 months instead of the usual 3–5 years [10]. For maximum valuation, agencies often aim to hit a "hockey-stick" threshold of 10–15 patents, which can significantly enhance their appeal to investors and acquirers [11].

Beyond valuation, documented IP reduces dependence on the founder, which is critical during a sale. If you’re responsible for more than 30% of client relationships, sales efforts, or service delivery, the agency will likely be seen as overly reliant on you - resulting in a multiple discount of 1x–2x [12]. Proprietary tools, well-documented processes, and transferable IP assets demonstrate to buyers that the business can operate independently, protecting its value.

On the flip side, failing to secure your IP can quickly erode these benefits.

The Cost of Unprotected IP

While strong IP can elevate sale value, unprotected or poorly managed IP introduces financial risks that can derail a deal. Buyers often lower their offers if they discover expired trademark registrations or incomplete IP filings during due diligence [13]. For example, in a 2025 case documented by Partridge Snow & Hahn, a buyer found that the seller’s website was registered to a defunct web developer. Since the developer was unavailable to transfer ownership, the buyer insisted on setting aside a portion of the purchase price in escrow until the issue was resolved [13].

Ownership gaps in IP, especially from contractor work, can be particularly costly. Agencies frequently assume they own work created by freelancers, but without written “work for hire” or assignment agreements, those assets cannot legally transfer to a buyer [5]. Restrictions on IP, such as distribution agreements that limit access to high-revenue sales channels, can even lead buyers to walk away from a deal entirely [13]. In another case from 2025, a seller discovered during negotiations that a third party had registered their brand names and logos in China. This oversight led the buyer to demand a significant price reduction to account for the risk [13].

Unprotected IP also increases indemnification risks. Sellers with weak IP protections or unauthorized use of third-party content may be forced to include strong indemnification clauses in the sale agreement, leaving them exposed to future infringement claims [13]. As Katie Rubino, a partner at Wiggin and Dana, explained:

"The median exit value for patent companies is 154.9% higher than it is for nonpatent companies per year on average, underscoring the powerful role IP plays in driving valuation and deal outcomes" [10].

The reverse holds true as well - weak or neglected IP can drag down valuation quickly and significantly. Properly securing and documenting your IP isn’t just a legal necessity; it’s a financial imperative.

StealthCFO's Role in IP-Driven Agency Sales

Installing Decision-Grade Financial Models

Most founders rely on financial reports, but these often fail to provide the insights buyers are looking for. StealthCFO steps in by creating financial models that go beyond surface-level data, focusing on the economic impact of your intellectual property (IP). These models isolate the extra cash flows generated by proprietary assets and calculate Adjusted EBITDA by factoring in Seller's Discretionary Earnings and adjusting for market-rate replacement salaries [17][18]. This approach uncovers profitability after acquisition - something a standard P&L report simply can't deliver.

A key tool in this process is the "with and without" method, which measures the profitability of your offerings with your IP against profitability without it. This isolates the incremental value your IP brings to the table. For instance, if you’ve developed a proprietary project management tool that increases efficiency, the model quantifies the resulting cost savings and margin improvements. Buyers value this level of precision - companies with strong IP, such as patented products, often achieve profitability rates three to four times higher than those without [15].

To ensure accuracy, StealthCFO combines multiple valuation methods - Income, Market, and Cost - to cross-check results and reduce the risk of mispricing [8]. This creates a defensible valuation range that stands up to buyer scrutiny. As Shawn Fox, CPA, ABV, CFA, ASA, CFF, puts it:

"IP valuation has so much subjectivity. It's really a combination of art and science because of all the analysis that has to be performed along with a number of assumptions that must be made" [14].

By quantifying the true value of your IP, StealthCFO not only highlights its importance but also streamlines the sale process.

Reducing Risk During the Sale Process

Buyers are often wary of agencies that rely too heavily on their founders. StealthCFO mitigates this risk by ensuring your financial models demonstrate that your IP can operate independently of the founder. Building on the valuation methods mentioned earlier, these models show how your IP generates revenue without relying on personal relationships or founder involvement [6][16].

During due diligence, buyers will closely examine cash flow projections, discount rates, and revenue attribution. StealthCFO ensures these models are clear, well-documented, and able to withstand scrutiny. Sensitivity analyses are built into the models to show how changes in market conditions could impact valuation [8]. This level of transparency strengthens your negotiating position by clearly outlining the value of your intellectual property.

Conclusion

Intellectual property (IP) is the cornerstone of your agency's sale value. Today, intangible assets make up about 90% of the S&P 500's value, a dramatic increase from just 17% in 1975 [3]. For agency founders, this underscores a hard truth: proprietary processes, unique technology, and protected brand assets are what separate a strategic premium sale from a deal based on book value. Recognizing and treating your IP as a core asset is no longer optional - it's essential.

The data backs this up. Agencies with patent portfolios are six times more likely to achieve successful exits - 23% on public markets compared to just 4% without [3]. Strategic buyers are willing to pay more for IP that fills gaps in their own offerings, while financial buyers focus on how your IP drives recurring revenue streams [19].

One critical factor: buyers want cash flow that doesn’t rely on the founder. As Sharon Toerek puts it:

"Intellectual Property is an asset that can be turned into cash in the form of licensing income, royalties, additional professional fees, or an enhanced purchase price when the time comes for your agency to be sold" [1].

Without financial models that clearly isolate the incremental value of your IP, you risk leaving money on the table.

The time to act is now. Conduct an IP audit, ensure contractor ownership with airtight written agreements, and start registering trademarks immediately - applications can take 12–18 months [4]. Build financial models that show the profitability impact of your IP, both with and without it. This level of clarity is what separates agencies commanding premium valuations from those just trading hours for dollars.

FAQs

What steps should creative agencies take to document and protect their intellectual property (IP) before selling?

When gearing up for a sale, creative agencies need to take a thorough approach to managing and protecting their intellectual property (IP). Start by compiling a comprehensive inventory of all IP assets. Include critical details like creation dates, version histories, and ownership records. Confirm that copyrights, trademarks, and patents - if relevant - are properly registered and up to date.

Ensure contracts with clients and freelancers clearly assign ownership rights, leaving no room for ambiguity. Use tools like NDAs and licensing agreements to secure these rights further. Lastly, organize all registrations and agreements into a centralized system. This not only simplifies buyer due diligence but can also make your agency more appealing and valuable to potential buyers.

How do patents, trademarks, and copyrights affect the sale of a creative agency?

Patents, trademarks, and copyrights each serve distinct purposes in defining the value of a creative agency during a sale. Patents offer protection for inventions or technical innovations, granting exclusive rights for a specified period. Trademarks secure brand identifiers - such as names, logos, and slogans - and can be maintained indefinitely with proper use. Copyrights automatically cover original creative works, like designs or written content, and generally last for the creator’s lifetime plus an additional 70 years.

These intellectual property assets directly influence an agency’s valuation by strengthening its technical capabilities, brand identity, or creative portfolio. Effectively managing and showcasing these assets can make your agency more appealing to buyers and boost its overall market value.

Why is intellectual property (IP) seen as a growth driver in agency valuations?

Intellectual property (IP) isn’t just something to list on your balance sheet - it’s a powerful revenue driver for creative agencies. Proprietary ideas, unique processes, and original assets can generate steady streams of income through licensing agreements, franchising opportunities, or royalty payments.

When used strategically, IP doesn’t just contribute to an agency’s earnings - it can also elevate its overall valuation, particularly in the context of a sale. Instead of being a passive line item, it transforms into an active growth engine, appealing to buyers who value its potential to deliver ongoing revenue and are willing to pay a premium for it.

Related Blog Posts

More Free Tools & Templates

For now, start where every serious founder does — with control.

© STEALTHCFO 2025 | TERMS & PRIVACY