How to Structure Royalty Deals in the Entertainment Industry

Creative & Entertainment Finance

Dec 1, 2025

Practical guide for founders on structuring royalty agreements to protect cashflow, set fair rates, enforce audits, and manage international tax and currency risks.

Most founders in entertainment think royalty deals are just about setting rates or negotiating advances. But the truth is this: a poorly structured royalty agreement can drain cashflow, spark disputes, and destabilise your business.

Royalty agreements aren’t just contracts - they’re financial systems that determine how you turn intellectual property (IP) into steady, predictable income. Done right, they protect your margins, simplify global revenue streams, and keep your business in control as it scales. Done wrong, they lead to missed payments, legal disputes, and financial uncertainty.

Here’s what matters most when structuring royalties:

Clarity on payment terms: Gross revenue vs net profit models have very different cashflow impacts.

Audit and enforcement mechanisms: Without them, you’re at the mercy of inaccurate reporting.

Global tax and currency planning: Cross-border royalties can erode margins if not managed properly.

Robust tracking systems: These ensure payments are timely, accurate, and aligned with your agreements.

This guide breaks down the financial and legal essentials of royalty agreements - so you can build deals that support growth, not chaos.

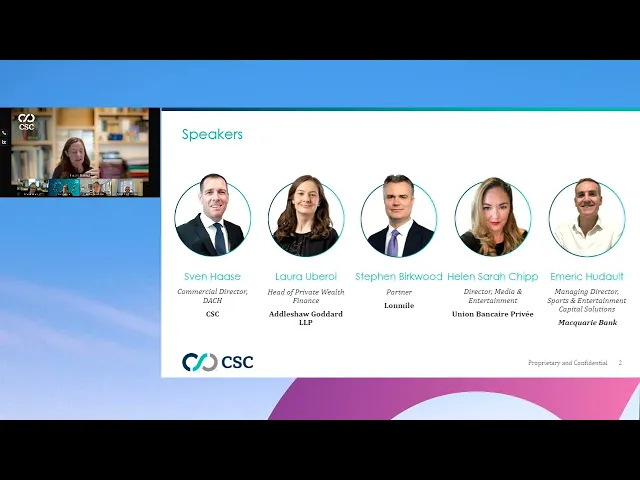

Structuring Deals and Investing in Sports and Entertainment

Royalty Fundamentals in Entertainment

Understanding royalties is crucial for anyone navigating the entertainment industry. At its core, a royalty is a recurring payment made to the owner of intellectual property (IP) whenever their work is used commercially. This arrangement creates an ongoing financial connection between the creator and those who use their work, allowing creative businesses to generate income repeatedly across different formats, regions, and time periods - all while retaining ownership of their IP.

The entertainment industry thrives on royalties because a single piece of IP can generate revenue in multiple ways at the same time. Take a song, for example: it can earn income from streaming platforms, radio airplay, live performances, and synchronisation in advertisements - all simultaneously. Each of these uses triggers a separate royalty payment, which is calculated, scheduled, and governed by its own set of contractual terms.

What makes royalties particularly appealing is the minimal additional cost after the initial creation of the work. Once a song, film, or book is produced, licensing it to more users incurs very little expense, but the potential for revenue remains high. This makes royalties a reliable income stream for businesses aiming for steady cashflow and financial stability.

However, royalty structures can be complex, varying based on the type of IP, the parties involved, and the regions where the work is distributed. Without a solid grasp of these fundamentals, businesses risk undervaluing their IP or signing agreements that are difficult to manage. A clear understanding of these basics lays the foundation for navigating the intricacies of royalty calculations and stakeholder roles.

What Royalties Are and How They Work

Royalties are payments tied to the commercial use of IP, designed to fairly compensate rights holders. These payments are often linked to usage metrics like sales figures, audience size, or streaming numbers, meaning income is directly tied to the success of the IP.

In film and television, royalties might depend on box office revenue, streaming views, or licensing fees. For instance, a production company licensing a documentary to a streaming platform might receive payments based on viewership numbers or a share of subscription income. Contracts define how royalties are calculated, how often payments are made, and whether there are any minimum guarantees or caps.

Music royalties, on the other hand, span several income streams. Songwriters earn mechanical royalties when their music is reproduced - whether through physical media, downloads, or streams. They also earn performance royalties when their songs are played publicly, whether on radio, in venues, or via streaming platforms. If the song is used in a film, advertisement, or video game, additional synchronisation fees come into play.

Publishing royalties work differently. Authors typically earn a percentage of a book's retail price for each copy sold, with rates varying by format - hardback, paperback, or digital. Additional income streams can come from audiobook rights, translations, or film adaptations, each with its own royalty terms.

The basis for royalty calculations is critical. Gross revenue royalties are straightforward, calculated on total income before deductions, offering transparency but potentially cutting into the licensee's profit margins. Net profit royalties, on the other hand, are calculated after deducting agreed expenses like marketing or production costs, which can significantly lower payouts to the rights holder. Choosing between these models has major implications for cashflow, making upfront negotiations essential.

Payment schedules also vary widely. Some agreements require quarterly payments, while others are semi-annual or even annual. For businesses relying on royalties to cover operational costs, delays in reporting or payment can create financial strain.

Who's Involved in Royalty Agreements

To structure effective royalty agreements, it’s essential to understand the roles of the key players involved. Each party has distinct responsibilities and interests, which influence the terms of the deal.

Licensors are the rights holders - the creators or owners of the IP. This could be a songwriter, producer, author, or production company. Their main priority is ensuring accurate and timely payments that reflect the actual use of their work.

Licensees are the businesses or individuals using the IP commercially. This might include record labels, streaming platforms, broadcasters, or publishers. Their focus is on managing costs and maximising the value they extract from the IP.

Collection societies act as intermediaries, especially in music and broadcasting. In the UK, organisations like PRS for Music and PPL handle royalty collection and distribution on behalf of rights holders. While they simplify administration, they charge fees for their services.

Distributors and sub-licensors add another layer of complexity. For instance, a UK production company might licence a show format to a US distributor, who then sublicenses it to local broadcasters. Each step introduces additional contracts, payment obligations, and potential delays.

Agents and representatives often negotiate royalty agreements on behalf of creators, particularly in music and film. While their expertise is valuable, they typically take a percentage of the royalties earned, which impacts the overall financial arrangement.

Local collection agencies in different countries manage royalties for international use. For example, a British composer whose music is played in Germany would rely on GEMA to collect performance royalties, which would then be transferred to PRS for Music before reaching the composer. This process can introduce delays and additional costs, such as currency conversion fees.

Different Types of Royalties in Entertainment

Entertainment royalties come in various forms, each with its own rules for calculation, collection, and payment.

Performance royalties are earned when a musical work is played publicly, whether on radio, TV, streaming platforms, or in public spaces like cafés or gyms. In the UK, PRS for Music handles these royalties, with rates varying based on factors like audience size and usage context.

Mechanical royalties are paid for the reproduction of music, covering everything from physical formats like CDs to digital streams. These royalties are administered by organisations like the Mechanical-Copyright Protection Society (MCPS) in the UK.

Synchronisation fees apply when music is used in visual media, such as films, TV shows, or advertisements. These fees are typically negotiated on a case-by-case basis, taking into account factors like territory, duration, and exclusivity.

Residuals are payments made to performers and crew when film or TV content is reused, such as through reruns or streaming. In the UK, unions like Equity and BECTU establish minimum rates and conditions for residuals.

Print royalties in publishing are based on book sales, with authors typically earning 7.5% to 10% of the retail price for hardbacks and 25% of net receipts for ebooks. Advances are paid upfront, with future royalties only kicking in once the advance is recouped.

Format royalties come into play when a television format is licensed internationally. For example, a UK game show format might be sold to broadcasters in other countries, with royalties tied to production budgets, ratings, or advertising revenue.

Managing these diverse royalty streams requires robust systems for tracking, reconciliation, and forecasting. For instance, a music rights holder might receive quarterly performance royalties, semi-annual mechanical royalties, and ad-hoc synchronisation fees. Without proper financial infrastructure, businesses can struggle to maintain accurate cashflow projections or identify discrepancies. These complexities highlight the importance of strategic planning in royalty agreements, which will be explored further in the next sections.

How to Structure Royalty Rates and Payment Mechanisms

Structuring royalty rates and payment mechanisms is where strategy meets execution. Do it right, and you secure steady revenue streams. Get it wrong, and you risk undervaluing your intellectual property and creating enforcement headaches.

Your royalty structure should reflect the value of your IP, align with market conditions, and support your financial goals. For instance, a music synchronisation agreement is nothing like a book publishing deal, and licensing a TV format differs from negotiating film residuals. The key is to design a system that’s both financially sound and operationally efficient. This means understanding how rates are calculated, choosing the right method, and ensuring mechanisms are in place to protect cash flow while allowing for growth. These decisions directly affect your ability to forecast revenue, manage working capital, and make informed business moves.

Setting Fair and Scalable Royalty Rates

Negotiating royalty rates is a balancing act, shaped by market trends, the value of your IP, and the leverage each side brings to the table.

The value of your IP: Proven intellectual property with a track record of success commands higher rates. A TV format that’s been adapted successfully across multiple regions, for example, can justify premium terms.

Market demand: When your IP is in high demand - because it fills a gap or aligns with current trends - you gain negotiating power. Conversely, crowded markets may force lower rates as licensees have more options.

Exclusivity: Exclusive rights typically come with higher royalty percentages, as they limit your ability to licence the IP elsewhere. Non-exclusive agreements, while lower per deal, can generate more income through volume.

Territory and duration: Global licences are more valuable than single-territory deals, and longer agreements often warrant better terms or higher advances. For example, a UK production company licensing a format exclusively to a US broadcaster for five years will likely secure far better terms than a short-term, single-territory deal.

Usage context: How the IP is used also matters. A song featured in a major ad campaign will command a higher fee than the same song used as background music in an indie film.

Royalty rates vary widely across industries, reflecting differences in business models and risks. To negotiate effectively, you’ll need to research industry standards, consult legal experts, and factor in your financial objectives. The goal is to ensure projected income supports your operational needs.

Scalability is another critical factor. A structure that works when your IP generates £100,000 annually might not hold up when revenue hits £1 million or more. Consider tiered rates that adjust as revenue grows, ensuring licensors benefit from success while keeping terms manageable for licensees.

Gross Revenue vs Net Profit Models

Choosing between gross revenue and net profit models is a pivotal decision, as each comes with its own risks, cash flow implications, and incentives.

Gross revenue models: Here, royalties are calculated as a percentage of total sales or revenue before any deductions. For example, if a streaming platform generates £500,000 in subscription revenue and your royalty rate is 3%, you’d earn £15,000, regardless of the platform’s costs. This model offers transparency and predictable income, insulating licensors from the licensee’s internal cost management. However, it shifts the financial risk to the licensee, who must pay royalties even if they’re not profitable.

Net profit models: In this approach, royalties are based on profits after deductions like production costs, marketing expenses, and taxes. For instance, if the same streaming platform reports £500,000 in revenue but incurs £400,000 in costs, the net profit is £100,000. A 10% royalty on net profit would yield £10,000 - less than the gross revenue model, despite the higher percentage rate. The challenge here lies in defining deductible costs. Without clear terms and audit rights, disputes can arise, and licensors might face unexpected shortfalls.

Gross revenue models generally provide more stable cash flow, as they’re tied to sales figures rather than profitability. However, net profit models can be appealing for partnerships with newer companies, deferring royalties until they turn a profit. In some cases, hybrid agreements that combine both approaches can balance risk and reward, such as using gross revenue for certain streams and net profit for others.

Advance Payments, Tiered Royalties, and Recoupment

Fine-tuning royalty structures often involves advance payments, tiered royalties, and recoupment provisions.

Advance payments: These are upfront sums paid to the licensor before royalties are earned. Advances provide immediate liquidity, which can be crucial for creators or businesses needing working capital. Typically, these payments are recoupable, meaning future royalties first go toward repaying the advance.

Tiered royalties: Rates that increase once certain revenue milestones are reached can ensure licensors benefit as the IP succeeds, while giving licensees manageable terms in the early stages.

These mechanisms not only improve cash flow timing but also balance risk between licensors and licensees, making the arrangement more sustainable for both parties.

Legal and Contractual Requirements for Royalty Agreements

When it comes to royalty agreements, a solid legal foundation is essential. A well-drafted contract ensures that intellectual property (IP) ownership is clear, payment terms are enforceable, and disputes can be resolved efficiently. Without these safeguards, you risk delays, misunderstandings, and costly conflicts.

A robust legal structure protects your IP, ensures timely payments, and provides a framework for handling changes or disputes. This is especially important in the entertainment industry, where IP can generate revenue for decades and across multiple regions. Strong contracts not only provide financial stability but also help you navigate the complexities of managing IP rights.

Let’s break down the key contractual elements that secure your IP and financial interests.

What to Include in Licensing Agreements

A licensing agreement is the blueprint for how your IP is used, who pays what, and under what conditions. Vague or incomplete clauses can lead to confusion, disputes, or delayed payments.

To start, clearly define the licensed asset. For example, if you're licensing a TV format, specify everything included: the format bible, episode structures, branding, and any additional materials. For music catalogues, list titles, registration numbers, and metadata. Ambiguity here can lead to disagreements over rights down the line.

Geographical scope and exclusivity should be explicitly outlined. For instance, a licence for "Europe" might raise questions - does it include the UK post-Brexit? Does it apply to streaming platforms or just physical distribution? Be precise. Exclusive licences often command higher royalties but limit your ability to licence the same IP elsewhere, so weigh the financial implications carefully.

Define the licence term with clarity, including start and end dates, renewal options, and termination rights. A five-year licence with a renewal option, for example, provides flexibility while maintaining certainty. Include provisions for early termination, citing specific reasons like non-payment or contract breaches.

Payment terms must leave no room for misinterpretation. Specify the royalty rate, how it’s calculated (gross revenue or net profit), payment frequency (monthly, quarterly, annually), and the currency involved. If tiered royalties or recoupment provisions apply, detail the thresholds and conditions. To discourage late payments, include penalties such as interest at 2% above the Bank of England base rate.

Audit rights are a must. Your agreement should allow you to review the licensee’s financial records, typically with reasonable notice (e.g., 30 days). If discrepancies exceed a certain threshold (e.g., 5%), the licensee may be liable for audit costs.

Other key clauses include permitted uses, sublicensing restrictions, and moral rights. For example, if you’re licensing a screenplay, specify whether the licensee can adapt it into other formats, like a stage play or graphic novel. Sublicensing clauses should define whether the licensee can transfer rights to third parties and under what conditions. In the UK, moral rights under the Copyright, Designs and Patents Act 1988 ensure you’re credited as the creator and protect against derogatory treatment of your work.

Protecting IP and Defining Ownership Rights

Protecting your IP is fundamental to maintaining revenue streams. Ambiguity over ownership or failure to properly register and enforce IP rights can jeopardise your royalty structure.

First, ensure all IP is registered. For trademarks, register with the UK Intellectual Property Office (UKIPO) or, for international licensing, through the World Intellectual Property Organization (WIPO). For copyrighted works, maintain clear documentation of creation dates and ownership. If patents are relevant, ensure they’re registered as well.

Ownership must be clearly defined in contracts. If the IP was created collaboratively - such as a TV format developed by writers and producers - ensure all contributors assign their rights to a single entity, often the production company or an IP holding structure.

Work-for-hire agreements are equally important when commissioning third parties. In the UK, copyright typically belongs to the creator unless it’s part of their employment or explicitly assigned in writing. For example, if you hire a composer for a soundtrack or a designer for branding, ensure the contract specifies that you own the resulting IP.

Enforcing your IP rights is just as crucial. Monitor how licensees use your IP, and act swiftly if you detect unauthorised use or breaches. Responses can range from cease-and-desist letters to renegotiation or, in severe cases, legal action. However, weigh the financial implications of pursuing legal remedies against the potential benefits. For minor infringements, a commercial settlement may be more practical.

Using an IP holding structure can simplify ownership and licensing. Consolidating IP in a single holding company reduces administrative complexity and can offer tax planning benefits, especially in jurisdictions with favourable tax treatment for royalty income.

Union and Performer Rights in the UK

In the UK, collective agreements and performer rights play a significant role in shaping royalty structures, particularly in film, television, and theatre. Understanding these frameworks is essential for compliance and avoiding disputes.

Equity, the trade union representing performers and creative professionals, negotiates collective agreements that set minimum terms for fees, residuals, and working conditions. If your production involves Equity members, you must adhere to these agreements, which may include minimum royalty rates or residual structures.

Performers’ rights are also protected under the Copyright, Designs and Patents Act 1988. These rights allow performers to control how their performances are used. Ensure your contracts secure the necessary permissions and clearly outline how residuals or royalties will be calculated and paid.

Collecting societies like Phonographic Performance Limited (PPL) and PRS for Music manage performer rights and distribute royalties. PPL handles royalties for public performances, broadcasts, and streaming of recorded music, while PRS focuses on royalties for songwriters, composers, and publishers. Your agreements should specify who is responsible for ensuring these payments are made.

Compliance with these standards is critical to protecting your revenue and maintaining the integrity of your contracts. Non-compliance can lead to legal disputes, penalties, and reputational damage. If in doubt, consult legal experts with experience in entertainment law and collective agreements.

Managing International Royalties and Cross-Border Issues

Handling royalties from intellectual property across multiple countries is no small task. It brings with it a host of challenges - tax obligations, fluctuating exchange rates, and compliance hurdles - that can quickly chip away at profits.

To navigate these complexities, you need a solid understanding of tax rules, currency strategies, and compliance systems across jurisdictions. This includes grasping withholding tax regulations, managing currency risks, and understanding the role of collection societies. Let’s dive into these critical areas.

Tax Implications and Double Taxation Agreements

One of the biggest hurdles in receiving royalties from abroad is withholding tax. Depending on the country and the type of intellectual property, withholding tax rates can range from 5% to 30%. For instance, a UK-based rights holder receiving royalties from the US could face a default withholding rate of 30%, which significantly reduces income.

Double Taxation Agreements (DTAs) offer a way to ease this burden. The UK has agreements with over 130 countries, which can lower or even eliminate withholding tax on royalties. Take the UK–US DTA as an example: it reduces the withholding tax rate on royalties to 0% in most cases, provided all treaty requirements are met. This typically involves obtaining a tax residency certificate from HMRC and submitting the correct IRS form, such as the W-8BEN for individuals or W-8BEN-E for entities. Without these documents, the full withholding tax applies, and reclaiming the excess can be a lengthy process.

Even with DTAs, royalties earned abroad must still be reported on UK tax returns. UK rights holders can often claim foreign tax credit relief to offset withholding tax paid overseas, but cashflow planning is key. For example, if a German licensee withholds 15% on a €100,000 royalty payment, only €85,000 is received upfront, and recovering the withheld amount could take months.

For businesses with substantial international royalty income, setting up an IP holding structure in a tax-friendly jurisdiction might help reduce withholding tax exposure. However, these arrangements must comply with anti-avoidance rules and demonstrate genuine commercial purpose through proper documentation.

Currency Exchange and Payment Logistics

Currency fluctuations can have a significant impact on the value of royalties paid in foreign currencies. For example, a quarterly payment of €50,000 might convert to £43,478 at an exchange rate of £1 = €1.15. If the rate shifts to £1 = €1.20, the same payment drops to £41,667 - a loss of over £1,800, even though the agreed amount in euros remains unchanged.

To minimise exchange rate risks, rights holders can negotiate contracts in pounds sterling where possible. If payments must be made in foreign currencies, tools like forward contracts or multi-currency accounts can help lock in favourable rates and reduce transfer fees. It’s also vital to clarify in agreements which party covers conversion and transfer costs to avoid any unexpected deductions.

Beyond managing exchange rates, ensuring compliance with cross-border regulations adds another layer of complexity.

Cross-Border Compliance and Collection Societies

Operating across multiple jurisdictions means dealing with varying regulatory frameworks, reporting requirements, and collection mechanisms. Non-compliance can lead to penalties, delays, or even the loss of rights.

Collection societies simplify the process of collecting royalties internationally through reciprocal agreements. For instance, SACEM in France collects royalties for music played there and transfers them for distribution in the UK. However, these systems often introduce delays, with payments sometimes taking 12 to 24 months or more to reach rights holders. This can create cashflow challenges, particularly for smaller organisations.

Transparency is another concern. Collection societies may not always provide clear details on how royalties are calculated or allocated. Including audit rights in licensing agreements ensures you can verify payments not just from direct licensees but also from sub-licensees or collection societies.

For audiovisual content, compliance becomes even trickier. Different countries have varying rules on performers’ rights, moral rights, and resale rights. For example, in the European Union, performers are entitled to equitable remuneration for public performances and broadcasting. These obligations should be explicitly outlined in licensing agreements.

VAT is another critical factor in cross-border transactions. In the UK, royalties for intellectual property use are generally subject to VAT if the licensee is based locally. For overseas licensees, VAT treatment depends on whether they are located in the EU or a non-EU country and on the applicable place of supply rules. Post-Brexit changes have added further complications, particularly for digital services and IP licensing. Rights holders may need to register for VAT in foreign jurisdictions to ensure compliance.

Additionally, international tax reporting requirements, such as those under the Common Reporting Standard (CRS), mean that financial institutions report account information to HMRC, which then shares it with foreign tax authorities. This makes accurate and comprehensive tax filings essential for rights holders with significant overseas income.

In short, managing international royalties requires precise contracts, robust financial systems, and constant oversight. As you expand into more territories, these demands only grow.

Building Systems for Royalty Management and Reporting

When it comes to managing royalties, having solid systems in place is not just a nice-to-have - it’s essential. Once royalty agreements are structured and cross-border challenges are addressed, the real work begins: tracking, enforcing, and reporting these agreements with precision. Without the right systems, you risk losing clarity on income streams and facing endless delays.

Many entertainment businesses underestimate how demanding royalty management can be. A production company might juggle dozens of licensing agreements, each with unique payment terms, reporting requirements, and calculations. Meanwhile, a music publisher could be managing royalties for thousands of compositions across multiple regions, with payments trickling in from streaming, broadcasts, and live performances. Without proper systems, this complexity can spiral out of control.

Effective royalty management hinges on three key components: tracking revenue streams, enforcing rights, and reconciling discrepancies. Let’s explore how these systems work to turn contractual terms into dependable cashflow.

Setting Up Royalty Tracking Systems

The backbone of royalty management is visibility. You need to know exactly what’s owed, when it’s due, who owes it, and whether payments align with the terms of your agreements. Achieving this level of clarity requires systems capable of managing multiple revenue streams, currencies, and calculation methods simultaneously.

Start with thorough documentation. For every agreement, clearly outline the payment terms (e.g., gross revenue or net profit), rates or formulas, payment schedules, reporting requirements, and any triggers, like recoupment points or tiered rates. This process often uncovers weak spots, such as vague clauses or missing audit provisions, which can later cause headaches.

Once agreements are documented, you’ll need a system to monitor payments. If you’re managing fewer than ten agreements, a diligently maintained spreadsheet might suffice. However, as the number of agreements grows, spreadsheets become prone to errors and harder to audit. That’s when dedicated royalty management software or a customised system integrated with your accounting platform becomes indispensable.

A good system should flag discrepancies immediately. For instance, if a payment due on 30 September hasn’t arrived by 15 October, the system should prompt follow-up actions. Similarly, it should highlight mismatches between reported revenue and calculated amounts.

To ensure accuracy, record payments in their original currencies and track conversion rates for consolidated reporting. This helps pinpoint whether shortfalls are due to calculation mistakes, currency fluctuations, or under-reporting.

For businesses heavily reliant on royalty income, integrating tracking systems with financial reporting is crucial. This ensures royalty income is woven into cashflow forecasts and management accounts, making it a core part of financial planning rather than an afterthought.

Audit Rights and Enforcement Mechanisms

Tracking systems are only part of the solution. To ensure compliance, you need strong audit rights and enforcement tools. Audits allow you to verify that royalties are calculated and paid correctly, and they place the financial burden of non-compliance on the party at fault.

An effective audit clause should cover key details: how often audits can occur (typically once a year or every two years), the notice period required (30 to 60 days is standard), and the scope of records that can be inspected. These records should include sales reports, distribution statements, financial accounts, and any sub-licensing agreements that impact your royalties. Additionally, the clause should specify that if underpayments exceed a certain threshold - commonly 5% to 10% - the licensee must cover the audit costs and pay the shortfall with interest.

While audits can be resource-intensive, they are typically reserved for high-value agreements or cases of suspected under-reporting. Even so, the presence of a robust audit clause often serves as a deterrent, encouraging licensees to maintain accurate records.

Beyond audits, enforcement mechanisms should include remedies for non-payment or under-reporting. These might involve late payment interest - often 2% to 4% above the Bank of England base rate - or the right to terminate an agreement after a specified cure period. You might also withhold further rights or content until outstanding payments are resolved.

For collection societies and sub-licensees, enforcement can be trickier. When you don’t have a direct contractual relationship with the entity paying royalties, your ability to audit or enforce is limited. In these cases, your primary licensee should be contractually required to ensure sub-licensees meet the same reporting and payment standards. Including a right to audit sub-licensees in your primary agreement adds an extra layer of protection.

Reconciliation, Dispute Resolution, and Record-Keeping

Even with strong systems and audit rights, discrepancies are inevitable. Reconciliation processes are vital for identifying and resolving these issues promptly, preventing them from escalating into larger disputes.

Reconciliation starts by comparing the licensee’s royalty statements with your own records. This involves verifying revenue figures, checking that the correct royalty rate has been applied, confirming any deductions (like discounts or marketing costs) are contractually allowed, and ensuring currency conversions are accurate. For net profit deals, the process becomes more complex as you’ll need to scrutinise allowable costs and ensure no unauthorised expenses have been deducted.

When discrepancies arise, document them immediately and address straightforward errors, like miscalculations, without delay. If the licensee disputes your findings or refuses to provide supporting documentation, the issue may escalate.

This is where a well-drafted dispute resolution clause becomes essential. Such clauses typically outline a tiered process: initial negotiation, followed by mediation if needed, and arbitration or litigation as a last resort. Mediation is often preferred as it’s faster, more cost-effective, and confidential. Arbitration clauses should specify the governing law (English law is common for UK-based rights holders), the arbitration venue, and whether the decision is binding.

Record-keeping forms the backbone of royalty management. Retain all agreements, amendments, correspondence, payment records, and royalty statements for at least six years - the standard limitation period for contractual claims in the UK. For tax purposes, HMRC may require longer retention periods, particularly for international royalties.

Digital systems are far more efficient than physical files. Cloud-based platforms allow quick storage, searching, and retrieval of documents, which is invaluable during audits or disputes. These systems should also maintain a clear audit trail, showing who accessed or modified records and when.

For businesses managing large royalty portfolios, regular reconciliation routines are crucial. Monthly reconciliations catch discrepancies early, quarterly reviews help assess overall performance, and annual audits validate the accuracy of your systems while reassuring stakeholders.

Conclusion

Structuring royalty deals in the entertainment industry goes far beyond drafting a solid contract. It requires a financial framework that supports long-term creative goals. The difference between a deal that delivers steady income and one that leads to uncertainty lies in how carefully aspects like royalty rates, payment terms, intellectual property (IP) protections, and enforcement mechanisms are addressed.

Setting royalty rates that align with both market conditions and your cost structure ensures deals remain workable as your business grows. Deciding whether to base royalties on gross revenue or net profit isn’t just a contractual choice - it has a direct impact on cashflow predictability and the level of financial transparency you’ll need from licensees. While options like advances, tiered rates, and recoupment clauses can provide flexibility, they only work effectively when backed by clear triggers and enforceable terms.

Legal precision is key to safeguarding your position. Licensing agreements must clearly define ownership rights, restrict sub-licensing without consent, and include audit clauses that allow you to verify compliance. In the UK, where performer and union rights are legally protected, failing to address these obligations can lead to legal trouble and damage to your reputation.

International royalty deals bring additional challenges. Tax treaties, withholding taxes, currency fluctuations, and cross-border collection processes all affect how much income reaches your accounts. Navigating double taxation agreements and structuring payments through the right entities can significantly reduce withholding tax burdens, helping to retain more of your revenue. While collection societies play an important role, their timelines and fees mean you’ll need systems that account for delays and deductions.

Once contracts are signed, the real work of royalty management begins. Effective systems turn contractual terms into actionable processes. Whether you’re tracking payments across multiple deals or reconciling income from various countries, you need a clear view of what is owed, when it’s due, and whether payments meet expectations. Audit rights and enforcement measures hold licensees accountable, while thorough reconciliation processes catch errors before they escalate into disputes.

Businesses that succeed with royalty-driven models treat their financial systems as seriously as their creative output. They integrate royalty income into cashflow forecasts, maintain detailed records, and actively enforce their rights. A royalty deal isn’t just a one-time transaction - it’s an ongoing financial relationship that demands constant oversight, regular evaluation, and swift action when terms are breached. This approach underpins the sustainable royalty framework discussed throughout this guide.

FAQs

What is the difference between gross revenue and net profit royalty models, and how do they affect cash flow?

Gross revenue royalty models work by calculating royalties as a percentage of total revenue before any expenses are taken out. This ensures rights holders receive consistent payments, which can be appealing. However, for businesses with high operating costs or unpredictable income, this model might put a strain on cash flow.

Net profit royalty models take a different approach. Royalties are calculated based on profits after expenses have been deducted. While this can ease cash flow pressures, it adds a layer of complexity. Agreements need to clearly define which costs are deductible, and disputes can arise if the calculations lack transparency or if expenses are inflated.

Deciding between these models comes down to balancing fairness with financial practicality. Gross revenue models tend to work well for straightforward agreements, while net profit models are often better suited to long-term partnerships where costs can vary significantly.

How can businesses in the entertainment industry manage international royalties and reduce the risks of currency fluctuations?

Managing international royalties in the entertainment industry demands careful planning to tackle cross-border challenges and minimise the risks tied to currency fluctuations. One effective approach is to use hedging strategies such as forward contracts. These allow you to lock in exchange rates, shielding your finances from unpredictable market swings.

Another practical step is maintaining foreign currency accounts. By holding funds in multiple currencies, you can avoid frequent conversions, saving time and reducing unnecessary fees.

It’s equally important to keep a close eye on exchange rates and market trends. This helps you anticipate shifts and make informed decisions. Including currency fluctuation clauses in contracts is another smart move, as it allows payment terms to adapt to significant changes in exchange rates.

By blending these strategies, businesses can build a more reliable system for navigating the complexities of international royalties.

What key legal factors should be considered when drafting royalty agreements to protect intellectual property and comply with performer rights in the UK?

When creating royalty agreements in the UK, it’s important to spell out intellectual property rights clearly. This includes outlining who owns the rights, how they can be used, and any restrictions. Be specific about how royalties will be calculated and paid, covering areas like residuals, box office revenue, and syndication income if relevant.

Don’t overlook performer rights under UK law. These rights, such as fair compensation for public performances or broadcasts, should be addressed in the contract. Strengthening protection by registering works with organisations like the Intellectual Property Office is also a wise step.

To stay on top of things, regularly check royalty statements for accuracy and keep thorough records. This helps ensure everything remains transparent and compliant with the terms of the agreement.

Related Blog Posts

More Free Tools & Templates

For now, start where every serious founder does — with control.

© STEALTHCFO 2025 | TERMS & PRIVACY