Cash Flow Systems for Scaling Agencies

Cashflow & Payroll

Jan 2, 2026

A practical framework for founders to align inflows, outflows, timing and reserves—prevent payroll shortfalls, reduce hiring risk, and forecast cash.

Revenue growth can mask cash flow risks, and ignoring this reality puts your agency’s future at stake. Many founders mistake strong revenue for financial health, only to face payroll crises, delayed hiring, or cash shortages when client payments lag behind expenses. The problem isn’t your ambition - it’s the lack of a system to align cash flow with the demands of a growing, payroll-heavy business.

As your agency scales, the stakes get higher. Payroll cycles don’t wait for late invoices, and hiring decisions carry more risk when cash reserves are thin. Without clear insights into inflows, outflows, and timing dynamics, every decision - whether to hire, invest, or expand - becomes a gamble. This isn’t just stressful; it’s unsustainable.

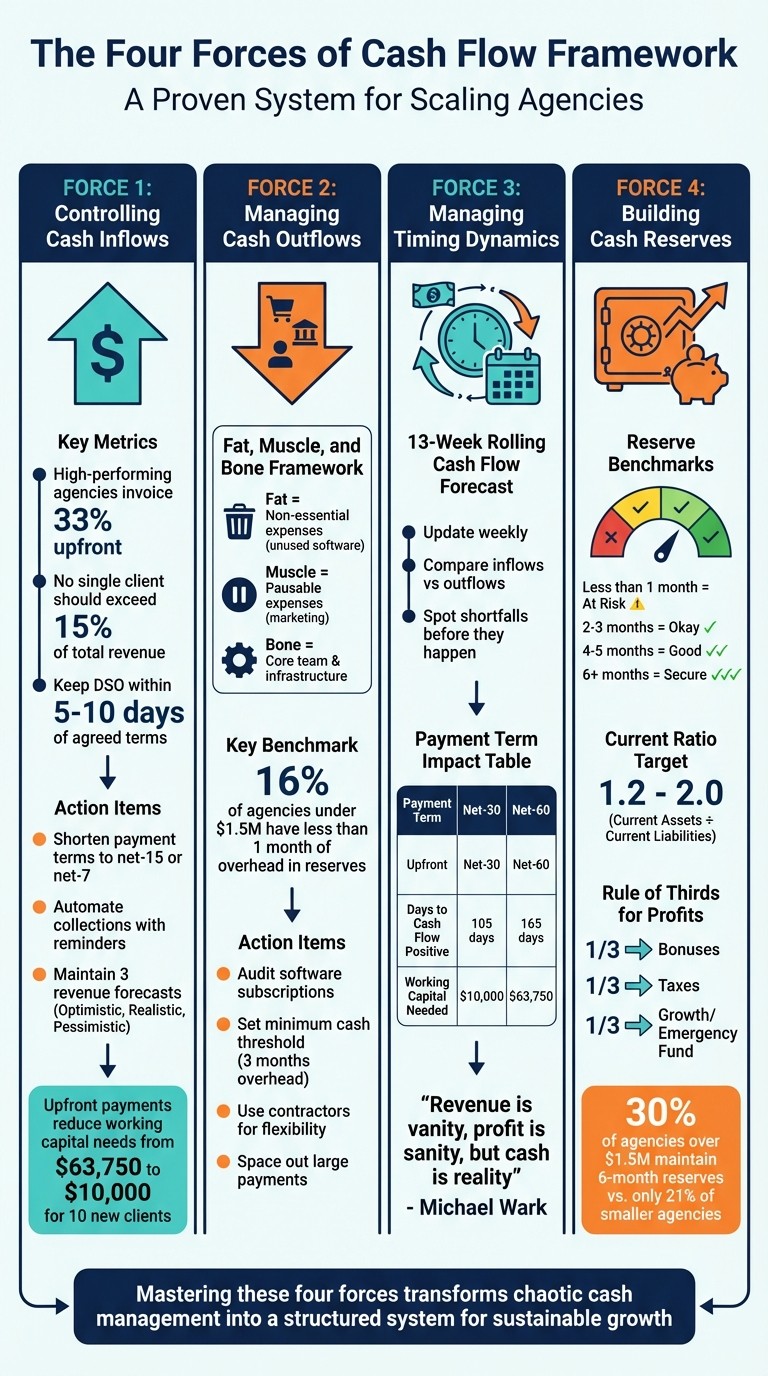

This article breaks down a proven framework to regain control: the Four Forces of Cash Flow. You’ll learn how to stabilize cash inflows, align outflows with revenue, manage timing mismatches, and build reserves that protect your business from uncertainty.

Four Forces of Cash Flow Framework for Scaling Agencies

Common Cash Flow Problems in Scaling Agencies

Payroll Risk and Hiring Exposure

The timing mismatch between biweekly payroll expenses and client payments arriving 30–45 days later creates a persistent cash flow challenge for agencies. This gap leaves agencies footing the bill for their operations long before receiving revenue for the work completed [3]. The problem worsens during growth phases, as hiring new employees to support a client contract locks in weeks of payroll obligations before any corresponding revenue materializes.

Terrayn Dispensary Marketing, under CEO Trevor Shirk, faced severe cash flow strains during "three-payroll months" - those with an extra payroll cycle due to five Fridays. Without a weekly cash forecast, these months caught the team unprepared [5]. Payroll isn’t just a fixed expense; it’s a timing risk. When client payments are delayed during periods of hiring, cash reserves earmarked for growth or marketing can vanish quickly. In extreme cases, unpaid wages can even expose founders to personal liability [3]. Addressing this structural imbalance requires proactive cash management rather than relying solely on backward-looking profit reports.

Adding to the payroll challenge, delayed client payments can further deplete cash reserves.

Client Payment Delays and Revenue Gaps

Late payments are a widespread issue, with 97% of marketing agencies reporting delays and 63% identifying them as a major source of unpredictability [10]. Nearly 60% of all business invoices are paid late, and almost half remain outstanding for over 90 days [11]. This forces agency leaders to focus on chasing overdue payments instead of driving growth.

The ripple effects are significant. Late payments lead to missed obligations for 27.5% of businesses [11]. Research from the UK's Federation of Small Businesses suggests that timely payments could have prevented 50,000 companies from going bankrupt [11]. For smaller agencies earning under $1 million, the stakes are even higher - 16% are considered "at risk", with less than one month of cash reserves to cover operating expenses [8]. Payment terms in contracts often obscure these liquidity challenges. Without tracking Days Sales Outstanding (DSO) and forecasting based on actual payment trends, founders are left making decisions without a clear picture of their financial health.

Gut-Driven Decisions Without Financial Clarity

When payroll risks and delayed payments collide, decision-making often suffers. Founders frequently rely on bank account balances or gut instincts rather than accurate cash flow data. Traditional financial statements - like balance sheets or income statements - use accrual accounting, which records revenue when earned, not when cash is received. This approach can distort the reality of available funds [9].

Dan Delmain, founder of :Delmain, highlights the importance of cash flow management:

Cash flow management helps you meet your financial obligations. It helps you plan for the future. And it helps you decide when you need to push the accelerator or pull back [5].

The issue isn’t a lack of ambition - it’s the absence of actionable financial data. Without clear insights, agencies risk making critical decisions - like hiring senior staff, committing to long-term leases, or investing in growth initiatives - without knowing if the cash will be there to support them. This isn’t just a reporting issue; it’s a fundamental control problem.

Recognizing these cash flow challenges lays the groundwork for implementing the Four Forces framework to regain control over agency finances.

The Four Forces of Cash Flow Framework

Agencies often track profit and loss meticulously yet still find themselves running out of cash. The issue isn’t sloppy accounting; it’s the absence of a system to manage how cash flows in and out. The Four Forces of Cash Flow framework simplifies this by breaking cash flow into four key areas: Inflows, Outflows, Timing, and Reserves. These forces, while distinct, collectively determine whether your agency grows efficiently or struggles through one payroll crisis after another.

This framework isn’t about fancy dashboards or reconciliation reports. It’s about gaining clarity on your cash flow mechanics so you can confidently decide when to hire, invest, or weather a client loss. Inspired by Greg Crabtree’s Simple Numbers methodology, it’s tailored specifically for agencies where labor costs dominate.

Force 1: Controlling Cash Inflows

Cash inflows go beyond signing clients - they’re about timing and predictability. Agencies relying on net-30 or net-60 payment terms essentially act as financiers for their clients, which delays reinvestment and increases working capital demands. John Doherty, founder of EditorNinja, puts it plainly:

If you get paid up front, you can start acquiring new clients 3-5x faster than if your terms are net-30 or net-60 [6].

For example, net-60 terms delay recovering client acquisition costs by over five months. In contrast, upfront payments slash the cash needed to onboard 10 new clients from $63,750 to just $10,000 [6]. High-performing agencies typically invoice 33% upfront for projects ranging from $15,000 to $375,000 [8]. Diversifying revenue sources is equally important - no single client should contribute more than 15% of total revenue. This minimizes the risk of a cash crisis if a major client churns [5].

Stabilizing inflows also involves moving away from hourly billing toward predictable service packages, such as tiered offerings like “Good, Better, Best.” For performance-based agencies, collecting media spend upfront is critical to avoid cash flow mismatches that can drain reserves [4].

Practical steps to improve inflows include shortening payment terms to net-15 or even 7 days, automating collections with reminders and late fees, and closely monitoring Days Sales Outstanding (DSO) to keep it within 5–10 days of agreed terms [3][8]. Agencies should also maintain three revenue forecasts - Optimistic, Realistic, and Pessimistic - to prepare for unexpected client losses or market shifts [8][4].

By stabilizing inflows, you set a solid foundation to manage outflows effectively.

Force 2: Managing Cash Outflows

Payroll is typically the largest and least flexible expense for agencies. Unlike rent or software subscriptions, payroll obligations come due regardless of when clients pay. Effective outflow management isn’t about slashing costs indiscriminately - it’s about aligning labor costs with revenue while cutting unnecessary expenses.

The Fat, Muscle, and Bone Framework offers a structured way to trim costs. “Fat” includes non-essential items like unused software or unprofitable accounts. “Muscle” covers areas like marketing or business development that can be paused temporarily. “Bone” represents core team members and essential infrastructure that keep the business running [12]. As Chartered Accountant Jason Andrew notes:

Software subscriptions are the hidden killer of profitability. Those seemingly small $10-$50 per month, per seat subscriptions really add up [12].

For agencies earning under $1.5 million, 16% operate with less than one month of overhead in cash reserves - making disciplined cost management critical [8]. Setting a minimum cash threshold, such as three months of overhead, ensures you have a financial buffer [8]. Flexibility can also be achieved by favoring freelancers or contractors over full-time hires, allowing expenses to scale with project demand [2]. Additionally, spacing out large payments - like rent or taxes - to align with client inflows can prevent liquidity issues [8][2].

During tough times, clear communication is essential. Trevor Shirk, CEO of Terrayn Dispensary Marketing, underscores this point:

I also hold myself personally responsible for handling it so I can make payroll, retain my employees, and keep the business running [5].

Force 3: Managing Timing Dynamics

An agency can appear profitable on paper yet face insolvency if cash is tied up in unpaid invoices or working capital. Timing dictates how quickly cash can be reinvested into client acquisition and whether payroll obligations are met during months with extra pay periods. As Fractional CFO Michael Wark explains:

Revenue is vanity, profit is sanity, but cash is reality [4].

A 13-week rolling cash flow forecast is the cornerstone of managing timing. This tool compares weekly cash inflows to outflows, helping you spot shortfalls before they happen. Updating it weekly ensures you can quickly address any variances [13]. For agencies experiencing rapid growth or tight cash flow, monthly forecasting isn’t enough - weekly or even daily monitoring is essential [7].

Timing mismatches often arise when agencies front ad spend or hire aggressively without matching revenue. Dan Delmain, founder of :Delmain, highlights the importance of timing control:

Cash flow management helps you decide when you need to push the accelerator or pull back – depending on what's going on in your industry or amongst your team [5].

Practical timing strategies include aligning invoices with major outflows, categorizing vendor payments by priority, and using milestone billing to generate steady cash inflows. Offering early payment incentives, like a “2/15 Net 30” model, can also accelerate receipts [1].

Payment Term | Days to Cash Flow Positive | Working Capital Needed | Reinvestment Start |

|---|---|---|---|

Upfront | Day 45 | $10,000 | 1 month after work begins |

Net-30 | Day 105 | $35,000 | 3 months after work begins |

Net-60 | Day 165 | $63,750 | 5 months after work begins |

By mastering timing, you can shift focus to building effective cash reserves.

Force 4: Building Cash Reserves

Cash reserves aren’t just a safety net - they’re a strategic tool. Reserves enable agencies to hire ahead of revenue, invest during downturns, or weather the loss of a major client. The standard benchmark is to hold enough cash to cover multiple months of overhead: less than one month is “At Risk,” 2–3 months is “Okay,” 4–5 months is “Good,” and six months is “Secure” [8].

Agencies earning over $1.5 million tend to be more resilient, with 30% maintaining six months of reserves compared to only 21% of smaller agencies [8]. A healthy current ratio (current assets divided by current liabilities) for a scaling agency falls between 1.2 and 2.0 [3]. Ratios below 1.2 signal vulnerability to short-term cash shortages, while ratios above 2.0 may indicate underutilized cash that could fuel growth.

To build reserves, agencies often adopt a “rule of thirds” for profits: one-third for bonuses, one-third for taxes, and one-third for a growth or emergency fund [5].

Mastering these four forces transforms chaotic cash management into a structured system, setting the stage for sustainable growth and financial stability.

Installing Cash Flow Systems with a 90-Day Financial Control Sprint

The Four Forces framework lays the groundwork, but turning those principles into action is where the real challenge lies. Many agency founders already have financial reports, yet they often hesitate when making critical decisions about hiring, pricing, or scaling. At StealthCFO, our 90-Day Financial Control Sprint is designed to bridge this gap, installing financial systems specifically tailored to payroll-heavy B2B agencies.

This isn’t just about tidying up your financial reports - it’s about creating systems that drive action. The sprint is a focused, short-term initiative that delivers a 13-week rolling cash flow forecast, uncovers hidden costs through expense audits, refines payment terms to improve cash flow, and introduces service productization to stabilize future revenue streams. These processes enable faster, more confident decision-making. By the end of the sprint, you’ll have clear insights into upcoming payroll obligations, working capital requirements, and the right timing for hiring or investments. It’s about taking the Four Forces from theory to daily execution.

What the 90-Day Sprint Delivers

The sprint installs four key systems to strengthen your financial infrastructure:

13-Week Cash Flow Model

Updated weekly, this model provides a clear view of your short-term financial outlook, helping you anticipate and manage upcoming expenses and working capital needs. Unlike generic templates, the forecast is customized to reflect your agency’s unique payment cycles, seasonal trends, and hiring plans, ensuring it aligns with your operational reality.

Expense Auditing

By analyzing credit card statements and recurring subscriptions, expense audits identify unnecessary costs - such as unused software licenses or excessive travel spending - that quietly drain cash reserves

Payment Term Optimization

Moving from traditional net-30 or net-60 payment terms to net-7 or upfront models accelerates cash flow, allowing faster reinvestment in growth opportunities

Service Productization

Transitioning from hourly billing to structured packages - like "Good, Better, Best" tiers - not only simplifies invoicing but also makes revenue streams more predictable, reinforcing financial stability

Beyond these systems, the sprint introduces a weekly finance huddle - a short 15- to 30-minute meeting where leadership reviews cash positions and aligns on upcoming liquidity needs [3].

Results: Before and After Implementation

Agencies that complete the sprint often see three measurable improvements in their cash flow management:

Better Forecast Accuracy

The 13-week model provides a clearer picture of future expenses and working capital, reducing the stress of living payroll-to-payroll

[5].

Lower Cash Outlay for Growth

Optimized payment terms, such as upfront invoicing, speed up cash reinvestment in client acquisition efforts

[6].

Increased Confidence in Decision-Making

Founders shift from relying on instinct to making data-driven decisions, using rolling forecasts to plan hiring, pricing, and investments with greater clarity

[4].

Take Design de Plume, for example. By implementing real-time reporting and automating invoicing, they curbed revenue losses from scope creep and boosted project profitability by 20% [14]. Additionally, the sprint helps agencies establish a cash reserve goal - ideally six months of overhead - to act as a financial buffer during slow seasons or unexpected client departures [8].

This structured approach transforms cash flow management from a reactive struggle into a proactive system, empowering agency leaders to make decisions with confidence and clarity.

Conclusion: From Reaction to Control

The way an agency handles its finances often separates those stuck in a reactive cycle from those in control. Reactive founders constantly check their bank balance to see if payroll will clear, make hiring decisions based on instinct, and stress over whether incoming invoices will arrive in time. In contrast, proactive founders rely on tools like a 13-week rolling forecast, hold consistent weekly finance meetings, and have a clear picture of their cash position months in advance. As Michael Wark aptly states:

Revenue is vanity, profit is sanity, but cash is reality [4].

The Four Forces of Cash Flow framework - controlling inflows, managing outflows, mastering timing, and building reserves - shifts cash flow from being a constant worry to a strategic asset. Agencies that implement strong inflow controls, such as upfront payments or 7-day terms, can reinvest in client acquisition up to five times faster than those stuck with net-30 or net-60 terms [6]. Speed matters, especially for payroll-heavy businesses. A reliable forecast means you stop second-guessing every hire and start making deliberate, data-backed decisions. This approach transforms chaos into clarity and sets the stage for sustainable growth.

The transition from reactive to controlled operations hinges on proven systems: a 13-week cash flow model updated weekly, payment terms that prioritize liquidity, regular expense reviews to plug leaks, and service productization to stabilize revenue. These systems are what separate agencies that scale efficiently from those that stall under pressure.

Next Steps for Growing Agencies

If you're still relying on gut instinct or your current bank balance to make decisions, growth will remain elusive and unpredictable. Consider these critical questions: Do you have a rolling forecast that shows your cash position for the next 90 days? Can you pinpoint when you can safely make your next hire without risking payroll? Do you know the minimum cash reserve you need to maintain - a clear boundary you won’t cross [8]? Answering these questions is essential to taking control of your financial future.

StealthCFO's 90-Day Financial Control Sprint is designed for founder-led B2B agencies with $3–10 million in revenue. This program integrates the Four Forces framework into your operations, delivering tools like a 13-week cash flow model and optimized payment terms. If you’re ready to move beyond firefighting and take charge of your finances, this sprint provides the structure and systems to help you scale with confidence and precision.

FAQs

What’s the best way for agencies to manage payroll when client payments are delayed?

Managing payroll when client payments are delayed requires careful planning and financial foresight. Start by developing a cash flow forecast that outlines expected client payments alongside your payroll obligations. This gives you a clear picture of when potential shortfalls might occur.

It’s also wise to maintain a reserve fund specifically for payroll or secure a short-term credit line to bridge any gaps caused by late payments. Another practical step is to align your payroll schedule - whether bi-weekly or monthly - with the timing of your client receipts. This alignment can help reduce the strain on your cash flow.

With thoughtful preparation and financial safeguards in place, agencies can consistently meet payroll obligations, even when invoices don’t arrive on time.

How can agencies make their cash flow more predictable?

To maintain better control over cash flow, agencies should implement rolling cash flow forecasts, such as 12-month projections. These forecasts allow you to anticipate revenue patterns and plan expenditures more effectively. Streamline your payment processes by tightening payment terms, sending invoices promptly, and following up on collections without delay to minimize cash flow interruptions. It's also essential to monitor key financial metrics like months of operating expenses covered - this helps you spot potential shortfalls early and address them before they escalate. These practices create a more predictable financial environment, especially as your agency grows.

Why is maintaining a cash reserve essential for agencies, and how much should they aim to save?

A solid cash reserve is essential for agencies to manage payroll, fixed costs, and unexpected hurdles like client non-payment or legal disputes. It acts as a safety net, ensuring operations continue smoothly and helping avoid impulsive, short-sighted spending during challenging times.

The general recommendation is to maintain cash reserves that can cover two to six months of expenses, which usually translates to 10–30% of annual revenue. This cushion not only strengthens financial stability but also minimizes the risk of poor decision-making as your agency grows.

Related Blog Posts

Search for more blogs

For now, start where every serious founder does — with control.

© STEALTHCFO 2025 | TERMS & PRIVACY