4 Forces Of Cash Flow: Risk Mitigation For Agencies

Cashflow & Payroll

Jan 8, 2026

Framework to protect payroll-heavy agencies from cash shocks by prioritizing taxes, managing debt, building core capital, and limiting owner payouts.

Most agencies don’t fail because of bad ideas - they fail because they run out of cash. And for payroll-heavy B2B agencies, cash flow isn’t just a number; it’s oxygen. You can be growing revenue, signing clients, and still feel like you’re one delayed payment away from missing payroll.

Here’s the reality: scaling makes cash flow harder to manage, not easier. The more you grow, the more payroll locks you into fixed costs, while client payments remain unpredictable. This creates a constant tension between growth opportunities and financial safety. Without a clear system for managing cash, decision-making becomes reactive, and the risks compound.

This article breaks down a practical framework - The Four Forces of Cash Flow - designed to give you control over your agency’s finances. You’ll learn how to:

Build tax reserves so you’re never blindsided by liabilities.

Manage debt without letting it distort your financial reality.

Protect your business with a core capital buffer that buys you time during downturns.

Handle profit distributions responsibly, ensuring long-term stability.

If you’re tired of relying on intuition to make decisions, this framework will help you operate with clarity and control. Let’s start with the first force: tax provisioning - the foundation for financial stability.

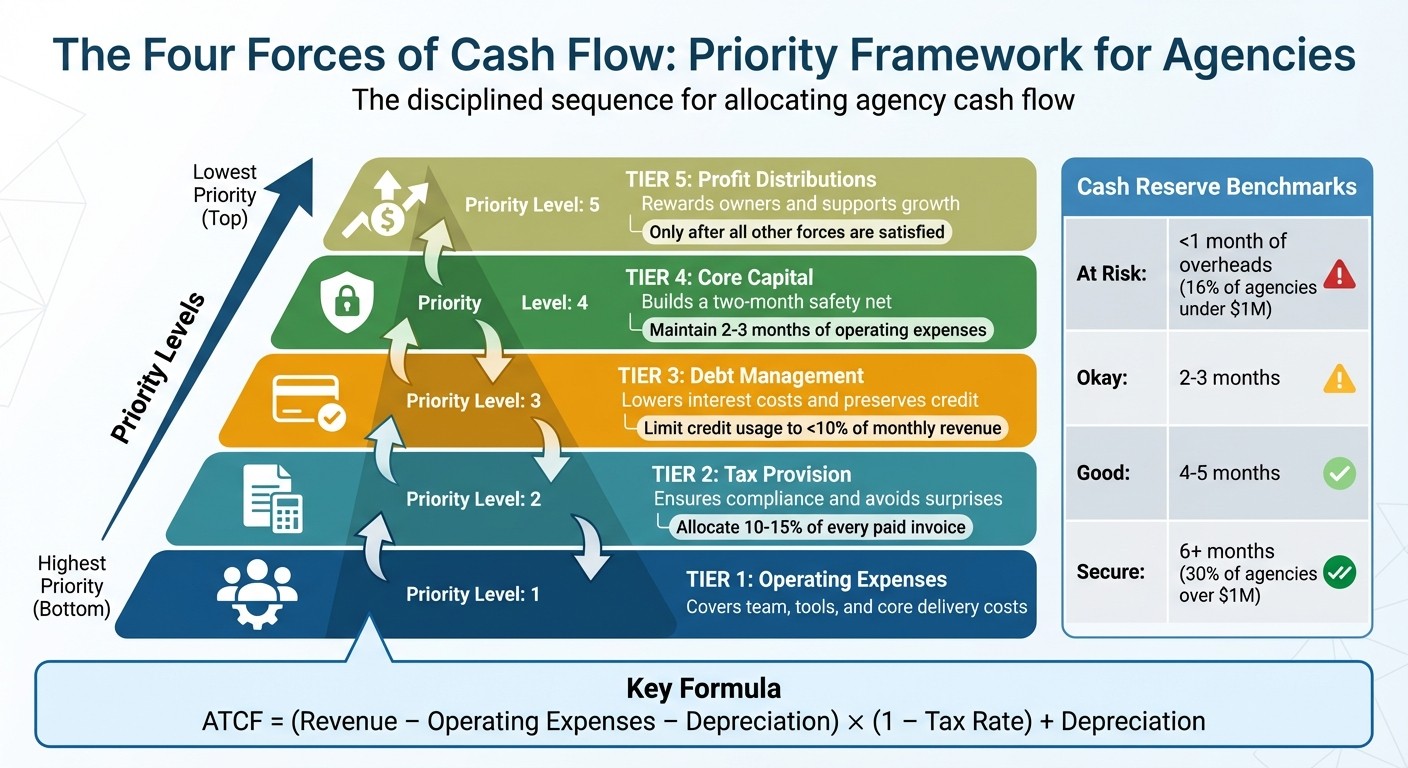

The Four Forces of Cash Flow Priority Framework for Agencies

Force 1: Tax Provision

Why Agencies Need Tax Provisioning

Tax obligations take priority right after payroll and operating expenses, coming even before debt payments or profit distributions [3]. Many agencies fall into the trap of viewing their bank balance - say, $200,000 - as entirely usable, overlooking the portion already earmarked for taxes.

Ignoring tax obligations creates a distorted view of your agency’s financial health. That inflated cash balance can lead to impulsive spending - like hiring too soon, signing up for unnecessary software, or upgrading your office space. When the tax bill arrives, it often forces agencies into costly, last-minute financing to cover the shortfall [3][1].

This issue is even more pronounced for agencies that experience "feast and famine" revenue cycles. High-revenue months create tax liabilities, but if you haven’t reserved cash, slower months can leave you scrambling to pay the bill. Over 60% of agency owners end up chasing overdue invoices, delaying the liquidity needed for tax deadlines [4]. Consequently, 13% of marketing agencies cite cash flow as their biggest challenge [1].

Michael Argento, CPA, emphasizes: "Build tax payments into your forecast so nothing sneaks up on you" [3].

Failing to plan for taxes leaves you in a reactive mode - constantly putting out fires instead of staying in control of your finances.

With these risks in mind, the next step is to create a structured approach to tax provisioning.

How to Implement Tax Provisioning

Start with a 13-week rolling cash flow forecast, treating tax payments as fixed outflows, much like payroll [3]. As Michael Argento points out, while this won’t eliminate tax challenges, it equips you to handle them more effectively [3].

Automate your tax sinking fund. Allocate a set percentage - typically 10% to 15% - of every paid invoice into a separate account that’s strictly off-limits for daily operations [4]. This ensures you have the funds ready for tax payments, reducing the temptation to spend them elsewhere.

Conduct weekly reviews to compare actual inflows with planned tax outflows and adjust your forecast accordingly [3]. Since agency revenue often fluctuates, it’s crucial to regularly update your tax provisions to align with those changes [10].

Finally, calculate your After-Tax Cash Flow (ATCF) using this formula:

ATCF = (Revenue – Operating Expenses – Depreciation) × (1 – Tax Rate) + Depreciation [11].

This gives you a clear picture of how much cash is truly available after accounting for tax liabilities, helping you make more informed financial decisions.

Force 2: Debt Management

The Risks of Short-Term Debt

Short-term debt - whether it's lines of credit, overdrafts, or high-interest loans - can distort your cash flow and mask the reality of your financial position. When you use credit to bridge gaps between operating costs and delayed client payments, you're essentially extending interest-free loans to your clients while still needing to meet biweekly payroll obligations [10].

This creates a vicious cycle. Rita Poliakov describes it as a "cycle of debt that can be difficult to break free from" [1]. The problem compounds when late payments force you to rely even more on credit, reducing your flexibility to make strategic moves. Every additional draw on your credit line narrows your options.

Debt also clouds judgment. Trevor Shirk, CEO of Terrayn Dispensary Marketing, shared:

We mismanaged cash probably two or three times where payroll became a really big deal [5].

When you're scrambling to meet immediate needs - like payroll or rent - you lose the ability to focus on long-term priorities like staff training, technology upgrades, or scaling the business. Debt forces a short-term mindset that prioritizes survival over growth.

Beyond operational challenges, debt can also hurt your reputation. Agencies under financial strain often cut corners on client work, damaging retention and making it harder to justify premium pricing [1][12]. Litto James from Richtr Financial Studio highlights the broader risks:

You can ruin your entire business by running out of cash, and the headache of trying not to miss important financial milestones like payroll, rent, taxes, or vendor responsibilities creates a lot of stress for business owners [8].

These challenges underscore the importance of disciplined debt management to avoid being trapped in a downward spiral.

How to Manage and Reduce Debt

Managing debt effectively requires a systematic approach. Start by prioritizing operating expenses and tax obligations before allocating funds to debt repayment or owner distributions [3]. Michael Argento stresses:

Service debt and LOC. Pay down principal and interest as planned - no more surprises [3].

A 13-week rolling cash flow forecast is an essential tool. Treat debt repayment as a fixed expense, just like payroll, to maintain visibility into short-term cash needs. Pair this with weekly cash reviews alongside your finance lead to compare actuals against forecasts and approve debt payments only when confirmed inflows are in hand [3].

Set a clear quarterly goal to eliminate short-term debt. If you’re unable to clear liabilities every 90 days, it’s a red flag that your labor productivity or margins aren’t sufficient to cover both operating costs and debt service [10].

Be cautious about taking on new debt. Only borrow when you’re absolutely certain about the timing of incoming client payments [1]. If a client insists on extended payment terms (60+ days), include the cost of financing in your project fees to cover the interest on the additional cash you’ll need to bridge the gap [9]. The Wow Company advises:

It's vital not to use funding to support an unprofitable business model. Be realistic and pragmatic when you're looking at the numbers [9].

Lastly, secure financing during profitable periods to lock in better rates, rather than waiting for a crisis [9][1]. This proactive approach ensures you’re prepared, rather than scrambling for unfavorable terms when options are limited.

Force 3: Core Capital

Why Agencies Need Core Capital

Core capital is the financial cushion that keeps your business afloat during tough times. For payroll-heavy agencies, this means holding at least two months’ worth of operating expenses in reserve. It’s not just a good idea - it’s a structural necessity.

Payroll is your biggest expense and the hardest to adjust on short notice. If a major client churns, payment terms stretch to 90 days, or the economy takes a hit, you can’t just slash payroll by 30% overnight without causing serious damage to your business. Ryan Kelly, CEO of Pear Analytics, puts it plainly:

Agencies can lose a significant amount of recurring revenue in a recession and have a difficult time scaling down labor costs. So you're faced with letting team members go to maintain margin or eat into your reserves and try to ride out the storm [1].

Without core capital, you’re left scrambling - cutting staff too soon, taking on bad-fit clients, or leaning on credit just to stay operational. Joseph Anthony, Digital Marketing Manager at Imageworks Creative, emphasizes the importance of this buffer:

Maintain a buffer to sustain operations during downturns while protecting your team and clients [1].

The numbers back this up. Smaller agencies earning under $1.3 million are far more exposed, with 16% operating on less than one month of cash reserves. By comparison, only 10% of larger agencies face this precarious position [9]. That’s not a margin for stability - it’s a margin for survival.

Cash Position | Security Level | Months of Overheads as Cash |

|---|---|---|

At Risk | Low | Less than 1 month |

Okay | Moderate | 2 to 3 months |

Good | High | 4 to 5 months |

Secure | Very High | 6 months |

The need for core capital is clear. The next challenge is how to build and protect it.

How to Build and Maintain Core Capital

Building core capital takes intentional effort. The first step is to tighten up how you manage client payments and allocate surplus cash. Start by invoicing faster. Top-performing agencies typically invoice 33% upfront for projects ranging from $13,000 to $325,000 [9]. This approach ensures you’re not financing client work out of your own pocket while waiting 60 or 90 days for payment.

Reduce your standard payment terms to 7 or 14 days instead of the typical 30. Even if large clients push back, starting with shorter terms strengthens your negotiating position [9]. For larger projects, use phased payments - such as 30% upfront, 30% at the midpoint, and 40% upon completion - to maintain steady cash flow [2].

As cash flow improves, prioritize building your reserve over taking larger owner distributions. Michael Argento, CPA and Founder of Argento CPA, offers this advice:

Aim for a two-month cushion of operating expenses. It gives you freedom to handle downturns or take risks without sleepless nights [3].

Set a hard minimum cash reserve - a figure you won’t dip below without triggering immediate cost-cutting measures [9]. Think of this as your “sleep at night” number. If reserves fall below it, you’ll know exactly what steps to take, whether it’s freezing hiring, cutting discretionary spending, or renegotiating vendor terms.

Finally, stabilize your revenue streams. Strive for a 70:30 split between retainer-based and project-based clients [2]. Retainers provide predictable income to cover your fixed costs, making it easier to maintain your reserves without the unpredictability of one-off projects.

Force 4: Profit Distributions

Profit distributions, like taxes, debt, and core capital, require strict discipline to ensure your agency's long-term financial health.

These distributions come last in the cash flow hierarchy - after all essential obligations have been met. Operating expenses, tax provisions, debt payments, and core capital reserves must be fully covered before any profits are distributed. The key metric to determine what’s truly available for distribution is After-Tax Cash Flow (ATCF) [3][11].

ATCF accounts for actual cash outflows, such as taxes and debt payments, while excluding non-cash items like depreciation. This gives a clear picture of the cash available for distribution without jeopardizing your operating reserves [11]. As Michael Wark, Fractional CFO at Trimline, succinctly puts it:

Revenue is vanity; profit is sanity; cash is reality [10].

When to Distribute Profits

Profit distributions should only happen once your agency has satisfied the first four cash flow forces and maintained consistent labor productivity. This means ensuring a two-month cash buffer, covering tax obligations, staying current on debt payments, and hitting your utilization targets.

A 13-week cash flow forecast is essential for identifying safe windows for distributions. Review this forecast weekly - ideally during a short "Weekly Cash Huddle" - to confirm that upcoming payroll, tax deadlines, and vendor payments are secure [3]. Michael Argento, CPA and Founder of Argento CPA, emphasizes:

Profit funds choice - distributions when stable, reinvestment when strategic [3].

For agencies that rely heavily on project-based income, distributions are inherently riskier due to uneven cash flow. If your revenue skews more toward one-off projects than retainers, you’ll need a larger cash buffer before making owner draws. Strive for a 70:30 retainer-to-project ratio, and ensure that essential operating costs are covered exclusively by retainer income. Treat any surplus from project work as discretionary, not as a foundation for fixed expenses [2].

This disciplined approach to profit distributions strengthens your overall cash flow management and reduces unnecessary risks.

Common Over-Distribution Mistakes

One of the most frequent mistakes agencies make is distributing profits based on gross revenue or a single strong month, rather than sustained after-tax profitability. Agencies earning between $2 million and $10 million often fall into this trap, pulling cash during a profitable quarter without accounting for upcoming tax bills or seasonal slow periods [3]. The result? They may find themselves relying on credit lines to cover payroll or scrambling to meet tax deadlines.

Another misstep is failing to reserve funds for reinvestment. Distributing every dollar of surplus leaves no room for hiring, upgrading technology, or weathering client churn. This shortsighted approach undermines long-term growth and stability.

Avoid these pitfalls to ensure that each layer of your cash flow system remains intact.

Priority Level | Cash Flow Force | Purpose |

|---|---|---|

1 | Operating Expenses | Covers team, tools, and core delivery costs. |

2 | Tax Provision | Ensures compliance and avoids surprises. |

3 | Debt Management | Lowers interest costs and preserves credit. |

4 | Core Capital | Builds a two-month safety net. |

5 | Profit Distributions | Rewards owners and supports growth. |

How to Apply the Four Forces Framework

The Four Forces framework becomes effective only when it’s embedded into your regular decision-making process. This means shifting from a reactive approach - like checking your account balance before paying bills - to a structured system that provides clear guidance on spending, hiring, and profit distribution.

Assess Your Current Financial Position

Start by calculating how many months of operating expenses you currently have in cash. This should include all overhead costs and owner compensation. According to BenchPress data, 16% of agencies earning under $1 million are operating "at risk" with less than one month of reserves, while 30% of agencies earning over $1 million maintain a six-month cushion [9]. Your immediate aim should be to build at least a two-month cash buffer before making discretionary decisions.

Establish a minimum cash threshold that triggers corrective actions, such as pausing hiring, postponing non-essential spending, or speeding up collections [9].

In your short-term cash projections, include all upcoming obligations - payroll, sales tax, income tax, and debt service. These aren’t surprises; they’re predictable costs that need to be factored in [3][8].

Also, take a close look at client payment behavior. If your terms specify 30 days but clients consistently pay in 60, that delay creates an unseen cash gap that must be accounted for in your baseline financial planning [9].

Set Clear Targets and Guardrails

Once you’ve established your cash position, define specific targets for each of the Four Forces:

Tax Provisions: Allocate 100% of estimated liabilities before taking owner draws.

Debt Management: Limit credit usage to no more than 10% of monthly revenue.

Core Capital: Maintain two to three months of operating expenses and aim for a 70:30 ratio of retainer to project revenue.

Profit Distributions: Follow a strict hierarchy: cover operating expenses, taxes, debt, reserves, and only then consider distributions.

As Michael Argento, CPA, explains:

“Forecast first, then decide which bills to pay. It’s the difference between proactive and reactive cash management” [3].

Regular Reviews and Adjustments

The Four Forces framework isn’t static - it requires ongoing adjustments. Implement a 13-week rolling forecast, updated weekly, and hold a Weekly Cash Huddle every Tuesday. This 20-minute meeting should focus on reviewing expected inflows, planned outflows, and your net cash position before approving any payments [3].

At the end of each quarter, compare your actual results against forecasts. Identify late-paying clients, unexpected expenses, and whether your core capital reserve is growing or depleting. Use this analysis to refine your plan for the next 13 weeks.

During these quarterly reviews, assess the Four Forces under three scenarios: Best Case (on-time payments), Moderate Case (minor delays), and Worst Case (revenue drops or significant late payments) [10][13]. As Michael Argento puts it:

“Think of it as your radar: it doesn’t stop the storm, but it tells you how to steer through it” [3].

This disciplined, iterative process forms the foundation for how StealthCFO integrates the Four Forces framework into effective decision-making.

How StealthCFO Helps Agencies Master the Four Forces

StealthCFO takes the Four Forces framework and transforms it into actionable steps through a structured 90-Day Financial Control Sprint. This approach integrates these principles into the daily operations of founder-led B2B agencies earning $3–10 million, especially those with payroll-heavy models. It’s designed to tackle the ongoing challenges of hiring decisions, cash allocation, and timing growth.

The sprint breaks into three focused phases:

Days 1–30: The first phase is all about assessment. It dives into cash flow drivers, liquidity, and internal controls to identify any underlying imbalances. A 13-week rolling forecast is created, which helps define your baseline cash security tier. Are you operating on the edge with less than a month of reserves? Or do you have the safety of a six-month cushion? This clarity is essential for understanding your financial position [9].

Days 31–60: Next comes stabilization. This period addresses collection delays, sharpens forecasting accuracy, and introduces a 20-minute Weekly Cash Huddle to compare actuals against the plan. As Michael Argento, CPA, puts it:

Forecast first, then decide which bills to pay. It's the difference between proactive and reactive cash management [3].

Days 61–90: The final phase focuses on creating a repeatable system. This includes documenting your financial playbook, establishing decision-making guardrails, and modeling scenarios for strategic planning. For instance, one agency used a 24-month forecast to evaluate the cash impact of expanding its office space and hiring new employees. The model gave them the confidence to increase their lease and take on a second floor [8].

Once the sprint wraps up, StealthCFO transitions to a monthly retainer model. This ensures ongoing governance of the Four Forces through quarterly reviews, rolling 12-to-24-month forecasts, and continuous adjustments. This isn’t about basic controller tasks or finance operations. It’s a structured governance system that keeps the Four Forces balanced as your agency scales, reinforcing the proactive discipline established during the sprint.

Conclusion

The Four Forces framework establishes a clear and logical sequence for how agency founders should allocate cash: Taxes, Debt, Core Capital, and Profit Distributions - in that order. This approach transforms cash flow from a constant source of stress into a tool for strategic decision-making. As Greg Crabtree emphasizes, maintaining a solid Core Capital target is critical to avoiding the pitfalls of undercapitalization [6].

The impact of adopting this framework is immediate and tangible. Agencies move away from impulsive, last-minute financial decisions and toward deliberate, forward-thinking strategies. They fund growth internally, reducing dependence on costly debt. They avoid over-distributing profits, which can leave them exposed when clients delay payments or projects hit unforeseen roadblocks. Most importantly, they build financial stability that allows founders to weather downturns without sleepless nights. This disciplined approach enables practical, actionable financial management.

To get started, conduct a thorough audit of your current financial position. Compare your tax reserves and Core Capital levels to your operating needs [6][7]. Calculate your Core Capital target as twice your average monthly operating expenses (excluding COGS). Take stock of all short-term debt and credit lines, and identify the gaps between your current state and your ideal targets.

Set clear financial goals and establish a quarterly review process to maintain control over your cash flow. While your priorities may evolve as your agency grows, the framework remains a constant guide. The objective is straightforward: take control of your cash flow rather than letting it control you. With these principles in place, shift from planning to execution.

The 90-Day Financial Control Sprint provides a structured path to evaluate, stabilize, and systematize your finances - embedding the Four Forces framework into your agency’s operations as a scalable, repeatable discipline.

FAQs

What’s the best way for agencies to handle unpredictable client payments and maintain healthy cash flow?

To manage the uncertainty of client payments, introduce a rolling 13-week cash flow forecast and conduct a brief weekly cash review. This approach helps you align anticipated client payments with upcoming payroll and other expenses. If payments are delayed, you can catch the issue early, giving you time to adjust spending or make alternative plans to prevent cash flow problems.

By consistently using these tools, you’ll gain clearer insight into your financial position and maintain the ability to handle payment delays without impacting your operations.

How can agencies build and maintain a reliable cash reserve?

To ensure financial stability, agencies should focus on building a cash reserve that covers 3–6 months of overhead expenses. This buffer acts as a safety net during lean periods. A practical way to manage this is by using a rolling 13-week cash flow forecast to track income and expenses. Pair this with a brief weekly cash review to confirm that spending stays on track with your projections.

Automate the process by setting aside a fixed percentage of profits directly into the reserve. At the same time, tighten your invoicing and payment terms to keep cash flowing smoothly. These steps not only safeguard your finances but also reduce the risks tied to critical business decisions.

Why should agencies prioritize setting aside funds for taxes?

Setting money aside for taxes is a straightforward way to stay ahead of your financial obligations. It eliminates the risk of unexpected cash shortages, penalties, or disruptions to your operations. Taxes aren’t unpredictable - they’re a fixed part of running a business. Prioritizing them in your cash flow planning ensures smoother finances and reduces the stress of last-minute scrambles. By reserving these funds upfront, you protect your agency's stability and make decisions with greater confidence.

Related Blog Posts

Search for more blogs

For now, start where every serious founder does — with control.

© STEALTHCFO 2025 | TERMS & PRIVACY