Cross-Border Tax Withholding for UK vs. US Agencies

Cashflow & Payroll

Jan 3, 2026

Guidance for founder-led agencies to manage UK–US withholding, secure treaty documentation, and embed withholding into forecasts to avoid cash shocks and liability.

If you’re not factoring cross-border tax withholding into your contractor payments, you’re gambling with your agency’s cash flow - and possibly your own liability. Most founders don’t realize that failing to withhold correctly doesn’t just create compliance issues - it directly impacts your bottom line. When you under-withhold, the IRS or HMRC doesn’t go after your contractors - they come after you. That’s not a risk you can afford to take.

Here’s the problem: as your agency scales, payroll and contractor costs become a bigger percentage of your expenses, and cross-border payments add layers of complexity. You’re not just managing invoices - you’re managing tax obligations that can blow up into penalties, interest, and even personal exposure if you get them wrong. Worse, treaty benefits that could lower withholding rates aren’t automatic. If you don’t have the right documentation at the time of payment, you’re stuck with default rates - 30% in the US, 20% in the UK - that can cripple cash flow and damage contractor trust.

This article will show you how to:

Avoid common withholding mistakes that lead to financial liabilities.

Use proper documentation to secure treaty benefits and reduce tax rates.

Build withholding obligations into your cash flow forecasts to protect margins.

Establish systems that eliminate guesswork and shield you from penalties.

The goal? To help you regain financial control over cross-border payments and make decisions with confidence - not fear. Let’s break down exactly what you need to know.

UK Tax Withholding Rules for Payments to US Contractors

When UK agencies pay US contractors, they must navigate HMRC's withholding rules. Certain cross-border payments - such as interest and royalties - are subject to a standard withholding tax of 20% unless proper documentation is provided. The US-UK Income Tax Treaty allows for reduced rates, potentially lowering withholding on interest and royalties to 0%. Dividend payments, however, are generally reduced but not entirely exempt from withholding tax under the treaty[6][3][8]. Here's a closer look at the rules and how to manage them effectively.

Default Withholding Rates in the UK

HMRC mandates withholding tax on specific payments to overseas entities. For dividends and interest paid to US contractors or parent companies, the default withholding rate typically ranges from 10% to 20%[6]. Royalties follow similar guidelines. However, payments for services, classified as "business profits", are generally exempt from UK withholding, provided the contractor does not have a Permanent Establishment in the UK[8].

Misclassification of a US contractor can lead to complications. If a contractor works fixed hours, uses your equipment, or operates under your direct supervision, HMRC may reclassify them as an employee. This reclassification triggers additional tax obligations, so ensuring proper classification is critical to protect your agency from financial risks.

How to Apply for Treaty Relief as a UK Agency

To take advantage of reduced withholding rates under the US-UK Income Tax Treaty, you'll need specific documentation. The key requirement is Form 6166, issued by the IRS, which certifies the contractor's US tax residency and eligibility for treaty benefits[7][8]. Without this form, the full 20% withholding rate must be applied.

To streamline the process, request Form 6166 during contractor onboarding and keep a copy for your records. This documentation is essential if HMRC audits your payments, as it confirms treaty relief was applied correctly. Failing to secure the form before payments begin could expose your agency to interest or penalty liabilities[4].

For most service payments, which the treaty classifies as business profits, withholding is not required as long as the contractor has no Permanent Establishment in the UK. For interest and royalties, treaty relief can eliminate withholding entirely, reducing the rate to 0%[3]. Dividend payments, however, are typically reduced to 15%, or as low as 5% for qualifying dividend payments[8]. Proper documentation ensures you can apply these reduced rates confidently.

US Tax Withholding Rules for Payments to UK Contractors

US agencies dealing with UK contractors must navigate specific withholding rules that differ from those in the UK. By default, the IRS requires a 30% withholding on FDAP (Fixed, Determinable, Annual, or Periodic) income such as interest, royalties, rents, and compensation paid to UK contractors [3]. This applies unless the contractor submits proper documentation to claim benefits under the US-UK Income Tax Treaty. Agencies that fail to withhold correctly can face personal liability [4]. Below, we break down the default withholding rules and the steps US agencies need to take to stay compliant.

IRS Default Withholding Rules and Treaty Adjustments

The 30% withholding rate applies only to income sourced from the US. For personal services, withholding is required only if the work is performed within the United States [4]. If the work takes place entirely in the UK, no withholding is necessary. Under the US-UK treaty, withholding rates are reduced for certain types of income: interest and royalty payments drop to 0%, while dividend payments are reduced to 15% (or 5% for certain qualifying cases) [3].

The IRS categorizes FDAP income as "fixed", meaning predictable in amount, and "determinable", meaning calculable [4]. Since most payments to contractors fall under this definition, understanding how income is sourced is critical to avoid withholding errors.

Compliance Steps for US Agencies

To ensure proper withholding and claim treaty benefits, US agencies must collect Form W-8BEN (for individual contractors) or Form W-8BEN-E (for entities) before issuing any payments [4]. These forms are essential for applying treaty benefits, as they confirm the contractor's residency and the treaty provisions being invoked. Contractors must complete Part II of the form to specify their residence and the applicable treaty article. Without valid documentation, agencies are required to withhold the default 30% rate [4].

Agencies should not rely on the form if the information provided appears inconsistent or questionable [4]. Verify that the contractor’s address and banking details align with the details on the form. If documentation is missing at the time of payment, agencies can later obtain a valid form to address the deficiency, though penalties and interest may still apply [4].

Additionally, agencies must file Form 1042-S by March 15 to report payments and treaty benefits, even if the withholding rate is reduced to 0% [1][4]. Form 1042, the annual withholding tax return, is also due on the same date [1][4]. Beginning January 1, 2024, the threshold for mandatory electronic filing has been lowered to 10 returns, meaning most agencies will now need to file electronically [1].

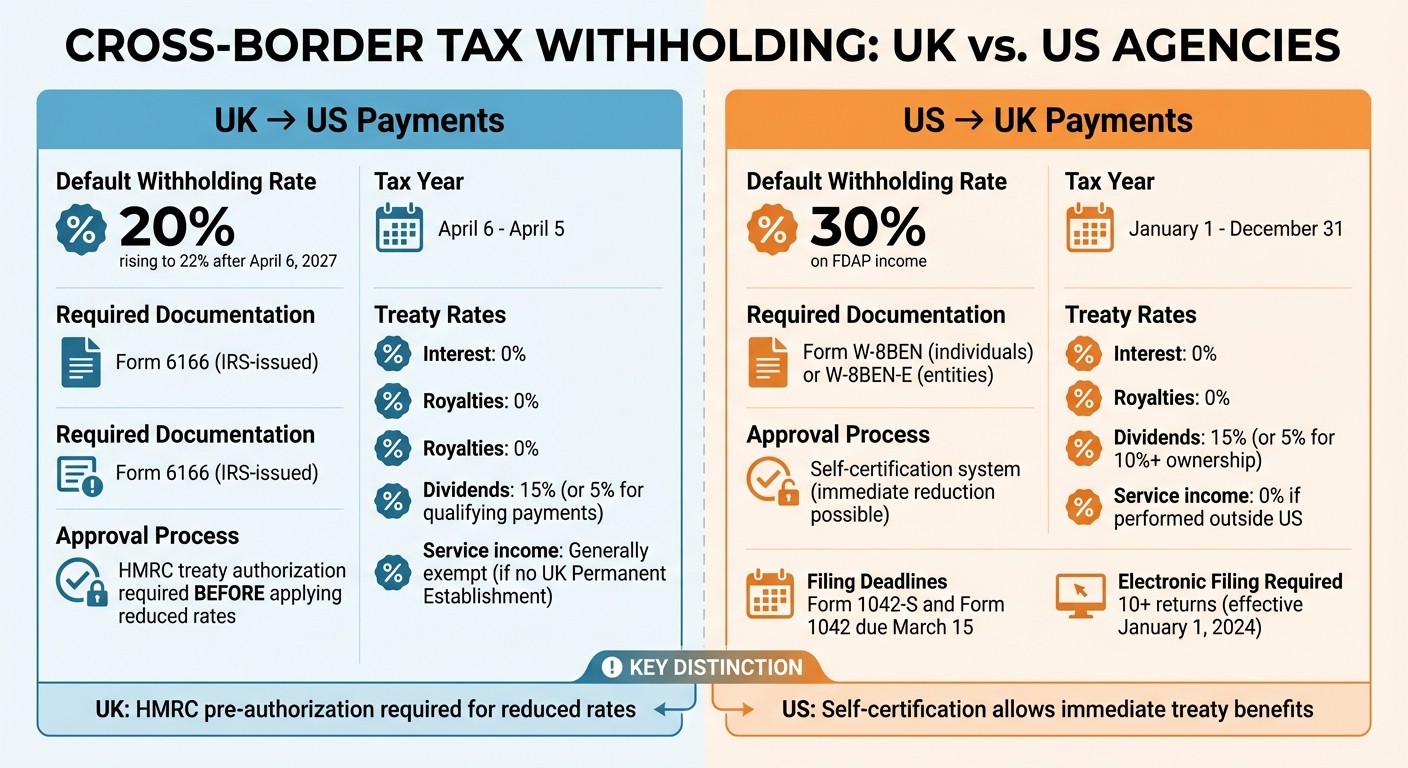

Key Differences Between UK and US Tax Withholding Rules

UK vs US Cross-Border Tax Withholding Rates and Requirements Comparison

The compliance burden for tax withholding varies significantly depending on whether your agency operates in the US or the UK. In the US, agencies face a statutory withholding rate of 30% on most US-source income paid to foreign individuals or entities [2]. Meanwhile, UK agencies typically apply a 20% withholding rate on interest and royalties paid to overseas contractors [6]. These default rates can be adjusted if treaty benefits are properly documented and claimed.

The process for claiming treaty benefits highlights a stark difference between the two jurisdictions. US agencies rely on a self-certification system where UK contractors complete Form W-8BEN or W-8BEN-E, enabling an immediate reduction in the withholding rate [4]. In contrast, UK agencies require US contractors to obtain formal approval from HMRC before any reduction or elimination of withholding can occur [11]. This procedural difference gives US agencies a faster path to compliance, while UK agencies face additional administrative hurdles when handling payments to US contractors. These distinctions lay the groundwork for understanding how payment types and documentation requirements further separate these systems.

Withholding Rates by Payment Type

The US-UK tax treaty provides specific reductions in withholding rates depending on the type of payment. For US agencies paying UK contractors, interest and royalty payments are reduced to 0%, while dividend payments drop to 15% - or even 5% for direct investment dividends where the recipient owns at least 10% of the company [3][9]. Similarly, UK agencies paying US contractors benefit from treaty reductions, though the baseline UK rate of 20% is set to rise to 22% for payments made on or after April 6, 2027 [11].

For service income, the rules differ further. Under US tax law, withholding applies to personal service income only when the services are performed within the United States [4]. If a UK contractor works entirely from the UK, no US withholding is required. However, UK agencies must carefully assess whether their relationship with a US contractor resembles employment, as HMRC may scrutinize and challenge cases where no withholding occurs [6]. These distinctions emphasize the critical role of accurate classification, which is handled differently in the US and UK systems.

Required Forms and Reporting Deadlines

The documentation and reporting timelines also diverge between the two jurisdictions. US agencies rely on self-certification forms like W-8BEN or W-8BEN-E and must meet a March 15 deadline for filing Form 1042-S and Form 1042 [1][4]. By contrast, UK agencies operate on a different tax calendar - running from April 6 to April 5 - and must secure HMRC treaty authorization to apply reduced withholding rates [10]. Without this authorization, UK agencies are required to withhold the full 20% rate to avoid penalties. Additionally, starting January 1, 2024, US agencies filing 10 or more information returns must submit them electronically [1].

These differences in forms, deadlines, and processes illustrate the distinct compliance landscapes that agencies must navigate when dealing with cross-border payments.

How to Reduce Compliance Risks and Maintain Financial Control

Maintaining financial control in cross-border transactions is a critical component of your compliance strategy. Cross-border tax withholding, in particular, exposes agency founders to serious liabilities and unexpected cash flow disruptions that can’t be fixed after the fact. The IRS holds the withholding agent - often the founder - personally responsible for unpaid taxes, including interest and penalties, even if the contractor fails to pay [4][5]. For example, if you don’t withhold 30% from a payment to a UK contractor and can’t provide proof of treaty eligibility, your agency must cover the full amount. This affects both your agency’s cash reserves and your personal financial exposure.

Building Tax Withholding into Agency Forecasts

A common misstep among agencies is forecasting contractor costs solely based on invoice amounts, overlooking withholding obligations entirely. This approach works - until it doesn’t. Imagine discovering you owe the IRS 30% of six months’ payments to a UK designer because they never submitted a Form W-8BEN. The solution? Treat withholding as an immediate cash expense in your forecasts. When planning payments to foreign contractors, assume the 30% statutory rate unless you already have proper documentation. For instance, a $5,000 invoice without a valid W-8BEN means you should expect a $1,500 withholding deposit. Once the form is submitted and the treaty rate drops to 0%, adjust future forecasts - but never assume treaty relief until documentation is confirmed [4].

You also need to account for varying deposit schedules. Incorporate cumulative withholding liabilities into your rolling forecasts, rather than focusing solely on individual payments. This will give you a clearer picture of your cash flow and obligations over time.

With accurate forecasting in place, integrating expert advice becomes the next step.

When to Work with Tax Advisors for Treaty Navigation

Some situations require professional input. For example, in the UK, HMRC may scrutinize payments to freelancers if the working relationship resembles employment [6]. In the US, if you’re unsure whether services were performed domestically or abroad, the IRS mandates treating the payment as US-sourced, requiring 30% withholding [4]. These are not situations where guessing is an option.

While the IRS permits retroactive fixes for under-withholding by obtaining documentation later, penalties for missing paperwork can still apply [4]. A tax advisor can help determine if a retroactive solution is feasible and guide you on the required documentation. If you’re managing multiple foreign contractors with different payment types - such as royalties, interest, or service income - expert advice can prevent costly errors before they escalate.

Using Financial Guardrails to Manage Cross-Border Payments

To protect your agency’s financial health, establish clear financial guardrails. The most effective measure is a "no form, no payment" policy. Require a valid Form W-8BEN, W-8BEN-E, or Form 8233 before processing any foreign contractor’s first invoice [4]. This policy eliminates the need for retroactive fixes and avoids the risk of defaulting to presumption-rate withholding. Flag vendors without proper US documentation [4]. If a contractor can’t provide the necessary forms, delay payment until they do - or factor the 30% withholding into the engagement’s cost from the outset.

For agencies scaling cross-border operations, this approach isn’t just about ticking compliance boxes. It’s about maintaining decision-grade financial control. When you fully understand the cost of foreign labor - including withholding obligations, deposit timing, and treaty documentation risks - you can price your services accurately, forecast with confidence, and sidestep personal liability. This is the difference between running a fragile agency and one that scales predictably and sustainably.

Conclusion: Making Cross-Border Tax Compliance Operational for Agencies

Cross-border tax withholding directly ties founders to personal liability. As explained earlier, maintaining proper documentation and embedding strong financial controls are essential to managing these risks. The IRS holds withholding agents - your agency - personally accountable for any unpaid taxes, interest, and penalties [4][5]. Every payment made to a foreign contractor without the right documentation puts your agency's financial health at risk.

To address this, you need to make immediate operational adjustments. The solution is simple but effective: treat withholding as a cash flow event. Until valid documentation is secured, plan contractor expenses using the 30% statutory withholding rate. Enforce a strict "no form, no payment" rule by flagging vendors without a valid Form W-8BEN, W-8BEN-E, or Form 8233 before processing their invoices. This approach not only protects your cash flow but also shields you from retroactive penalties [4].

For agencies expanding internationally, operational measures alone aren't enough. Scaling cross-border operations demands financial systems that integrate withholding obligations into your forecasts, pricing models, and hiring strategies. When you can accurately calculate the full cost of foreign labor - including withholding deposits and treaty considerations - you gain the confidence to price your services correctly, manage cash flow effectively, and eliminate the risks tied to guesswork.

If your current financial reporting tools can't keep up, you’ll need more specialized systems. Without decision-grade financial controls, your operations remain vulnerable. StealthCFO’s 90-Day Financial Control Sprint provides the guardrails and forecasting discipline necessary to turn compliance into a competitive edge. This is how agencies in the $3–10 million revenue range maintain financial control as they expand across borders.

FAQs

What are the main differences in cross-border tax withholding rules between the US and UK?

When handling cross-border payments, US-based agencies often default to a 30% withholding tax. However, under the US-UK tax treaty, this rate can be significantly reduced depending on the type of payment. For instance, dividends may be taxed at 5-15%, while interest and royalties can range from 0% to 10%. To qualify for these lower rates, the recipient must reside in the UK.

On the flip side, when UK-based agencies make payments to US entities, withholding taxes are also guided by treaty rates. For example, US-source dividends are typically subject to a 15% tax, while interest payments are often exempt from withholding altogether.

Grasping these treaty-specific provisions is essential to avoid overpaying taxes and to remain compliant. If these regulations feel overwhelming, StealthCFO can provide the expertise you need to navigate your cross-border financial decisions with confidence.

How can agencies properly apply US-UK tax treaty benefits to reduce withholding rates?

To make use of the US-UK tax treaty benefits, agencies must pinpoint the applicable treaty provision and ensure the foreign entity fills out Form W-8BEN-E correctly. Once completed, this form should be submitted to the US withholding agent, who will apply the reduced treaty withholding rate and report the corresponding Chapter 3 exemption code - such as 02 for reduced withholding - on Form 1042-S.

It’s equally important to keep all supporting documents well-organized for potential audits. Following these steps not only simplifies cross-border transactions but also helps avoid unnecessary tax issues.

How can agencies account for cross-border tax withholding in their financial forecasts?

To properly account for cross-border tax withholding in your financial forecasts, begin by pinpointing all revenue streams that could trigger withholding requirements, such as royalties, interest, or service fees. For U.S. withholding, the standard rate is 30%, but this can often be reduced under agreements like the U.S.–U.K. tax treaty, provided the correct certifications - such as W-8BEN or W-8BEN-E - are in place. Once you confirm the applicable rate, calculate the expected withholding for each transaction and incorporate it as a recurring cash outflow in your forecast.

Don't overlook state-level withholding obligations, as certain states may impose their own requirements independent of federal treaties. Use a tracker to reconcile your forecasted withholding amounts with actual filings, and update it whenever rates or treaty terms shift. By embedding withholding into your cash flow model and syncing it with your broader financial controls, you can sidestep unexpected shortfalls and ensure your business has the liquidity needed for payroll and growth investments.

Related Blog Posts

Search for more blogs

For now, start where every serious founder does — with control.

© STEALTHCFO 2025 | TERMS & PRIVACY