Scope Creep Costs: Lessons from Agency Failures

Financial Control

Jan 5, 2026

How unbilled revisions and unmanaged scope quietly erase cash and margins at payroll-heavy agencies and the financial controls founders need to stop it.

Scope creep isn’t just a project management headache - it’s a silent killer of agency profitability. Every unbilled revision, unpaid tweak, or delayed project completion directly erodes your margins, ties up resources, and creates cash flow stress. For payroll-heavy agencies, where labor costs are fixed and relentless, this isn’t a small problem; it’s a structural risk that compounds over time.

Why does this matter now? As your agency scales, the stakes get higher. Payroll doesn’t wait for late invoices, and fixed-fee projects leave no room for inefficiency. If you’re noticing tighter cash despite growing revenue, or if hiring feels risky because margins are unpredictable, scope creep is likely at the root of the issue. Worse, most agencies don’t catch the financial damage until it’s too late - when the project is over, the client’s moved on, and the profit is gone.

This article breaks down how scope creep quietly drains your agency’s profitability and what you can do to stop it. You’ll learn:

Why scope creep disproportionately hurts fixed-fee agencies

The hidden costs of unbilled labor and inefficient resource allocation

Practical systems to track, price, and control scope changes in real time

The goal is simple: to give you the financial clarity and control needed to protect your margins, improve cash flow, and make confident decisions as your agency grows. Let’s get into it.

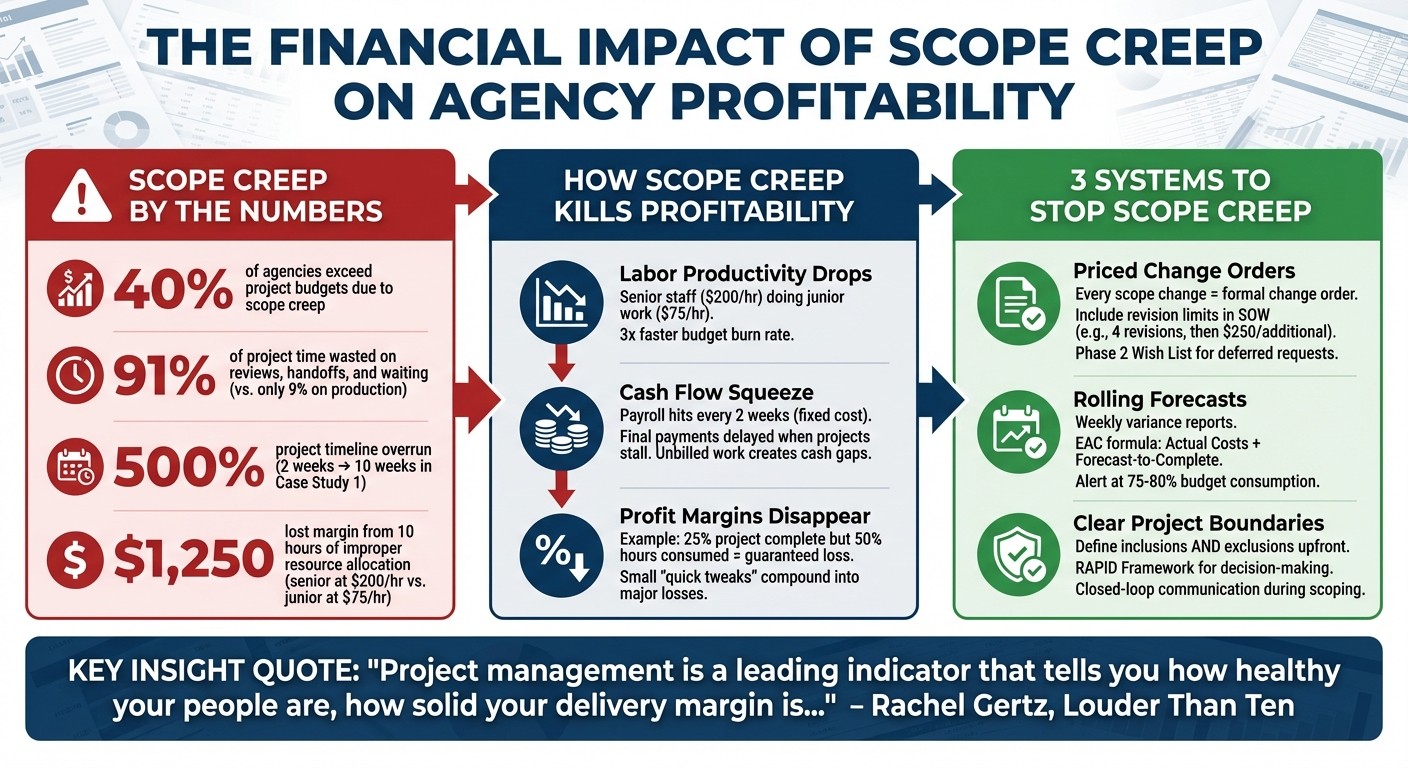

The Financial Impact of Scope Creep on Agency Profitability

3 Agencies That Lost Money to Scope Creep

These real-world examples highlight how seemingly minor scope changes can snowball into financial losses. They serve as a warning: even seasoned agencies with defined scopes and experienced teams can see their margins evaporate if they don’t catch scope creep early.

Case 1: Website Redesign Spirals Out of Control

A creative agency planned a website redesign as a two-week project, but it ballooned into a 10-week ordeal - a staggering 500% overrun. The culprit wasn’t one major change but a series of unbilled "quick tweaks" and excessive revision cycles. Originally scoped for four revisions, the project ended up with 12 rounds. Shockingly, only 9% of the total time went into production, while the remaining 91% was wasted on reviews, handoffs, and waiting [4]. The lack of weekly variance tracking meant the overruns went unnoticed until invoicing.

To make matters worse, resource mismanagement compounded the financial hit. A senior strategist, billed at $200 per hour, handled tasks that should’ve been assigned to a junior coordinator at $75 per hour. Over just 10 hours, this misstep cost the agency $1,250 in lost margin [3].

Case 2: Digital Campaign Stalled by Scope Changes

A digital agency launched a campaign on a fixed-fee basis, splitting payments 50/50 - half upfront and half upon completion. The sales team, eager to close the deal, set overly aggressive terms, leaving the delivery team with an unrealistic Statement of Work [3].

Midway through the project, the client requested additional features [9]. The agency, lacking a formal change request process, agreed without issuing updated terms. As the scope expanded, the project stalled indefinitely, and the agency never collected the second half of the payment [4].

This is a textbook case of "death by a thousand cuts": small, unbilled changes that quietly erode profitability. Without clear contractual boundaries or a defined process for handling extra work, the agency found itself stuck in a perpetual cycle of scope creep [8] [1].

Case 3: Platform Build with Undefined Scope

A development agency took on a custom platform build without charging for a scope definition phase. As the project progressed, the client introduced multiple stakeholders, each with conflicting opinions. Without a clear decision-making framework like RAPID, the agency struggled to manage the chaos [4].

Costs and timelines spiraled out of control as senior developers - billed at premium rates - were assigned tasks better suited for lower-cost team members [3]. The absence of weekly variance reports meant the overruns weren’t flagged until the damage was done [3].

Undefined boundaries didn’t just delay the project - they obliterated profitability. For comparison, large IT firms often charge $25,000 upfront for scope definition alone [5]. By skipping this step, the agency left itself vulnerable to significant margin erosion.

These examples make one thing clear: unchecked scope creep can devastate an agency’s financial health. In the next section, we’ll dive deeper into strategies for preventing these costly mistakes.

How Scope Creep Damages Agency Finances

The examples above aren’t unusual - they’re red flags of unchecked scope creep, a common issue in payroll-heavy agencies. When project scope expands without additional revenue, the financial fallout is predictable: labor productivity plummets, cash flow tightens, and profit margins evaporate. In fact, nearly 40% of agencies exceed their project budgets because of scope creep [1][2]. Let’s break down how this plays out in day-to-day operations.

Labor Hours Balloon and Productivity Drops

Scope creep doesn’t just tack on a few extra hours - it stretches timelines far beyond what was planned and disrupts task completion. As seen in earlier examples, hours that should drive progress instead get wasted on unbilled tasks. The team stays busy, but the output stalls.

Every unbilled hour is a missed opportunity to work on new, billable projects or to serve paying clients. It’s even worse when senior staff, billed at $200 per hour, are stuck handling tasks that a junior coordinator at $75 per hour could easily manage. This mismatch burns through budgets nearly three times faster [3]. Beyond the wasted hours, inefficient labor allocation increases the risk of poor decisions during project execution.

Rachel Gertz, co-founder of Louder Than Ten, highlights the warning signs: "When agencies can't keep their PMs, fire bells clang in my head. Project management is a leading indicator in your business that tells you how healthy your people are, how solid your delivery margin is... If PMs cycle through your agency like a revolving door, this tells me your agency is on fire or very soon will be." [6]

Cash Flow Gets Squeezed by Unbilled Work

Unbilled labor creates an immediate cash crunch. Payroll is a fixed cost that hits every two weeks, regardless of whether clients have paid. Many agencies rely on milestone-based payment terms - 50% upfront, 50% on completion. When scope creep delays project completion, the final payment is also delayed [4][6]. Meanwhile, payroll obligations continue, creating a cash flow gap.

This problem compounds when senior team members are assigned to small, unplanned tasks outside the original scope. These "quick tweaks" drain project budgets and cash reserves [3], effectively turning paid work into a financial liability.

Elyse Gagné puts it plainly: "Scope creep can cause serious cash flow problems if left unchecked" [6].

The result? A busy agency that struggles to meet payroll without tapping into reserves or postponing other critical investments. As cash flow tightens, the knock-on effect hits profit margins directly.

Profit Margins Disappear When Work Goes Unbilled

Unbilled work doesn’t just chip away at profit margins - it eliminates the financial control needed for sustainable growth. The math is unforgiving: if a project is only 25% complete but has already consumed 50% of the budgeted hours, it’s headed for a loss before it’s even finished [3]. Fixed-fee models, without strict controls, leave agencies exposed to escalating financial losses.

The damage often comes from small, incremental changes. Each "quick tweak" may seem insignificant, but over weeks, they add up, consuming hours that were originally budgeted for profit.

Michael Quinn, founder of My Site Ranked, emphasizes the balancing act: "The biggest challenge is balancing the needs and expectations of the clients while maintaining the scope of your agreement - and personal and professional boundaries" [6].

When scope boundaries are unclear, profit margins shrink until projects operate at a loss. It’s a slow bleed that can cripple an agency’s financial health.

How to Stop Scope Creep Before It Starts

Agencies don’t struggle because they lack talent - they struggle because they lack financial systems that track and price every scope change. Scope creep isn’t primarily a client issue; it’s a systems issue. Instead of doubling down on tougher negotiations or stricter contracts, agencies should focus on building financial controls that make every scope change visible, priced, and approved before the work begins.

Require Priced Change Orders for Every Scope Change

Every request outside the original Statement of Work (SOW) must trigger a formal change order - no exceptions. This isn’t about being inflexible; it’s about valuing your time. As Drew McLellan, CEO of Agency Management Institute, explains:

"By the time I calculate the change order cost, write up a document, and get it signed by the client, I could have just made the change. The reality, though, is that you can't afford to not issue change orders." [1]

The process is straightforward: document every extra request with a formal change order that prices the work before it begins. To set expectations early, include revision limits in your SOW (e.g., "This estimate includes four revisions; additional revisions will incur a $250 fee"). For requests that don’t fit within the current scope, move them to a Phase 2 Wish List - this ensures they’re deferred, scoped, and priced separately [2].

Once change orders are part of your workflow, dynamic financial tracking becomes essential to monitor shifting costs.

Use Rolling Forecasts to Track Project Costs in Real Time

Relying on a static budget created at kickoff is risky - it quickly becomes outdated as projects evolve. A rolling forecast, on the other hand, is a dynamic tool that tracks hours, expenses, and scope as they shift [10]. Robert Yuen, CEO and Co-founder of Monograph, explains:

"Your baseline budget shows where you hope to finish, but a living forecast shows where the project is actually heading as hours, expenses, and scope shift week by week." [10]

To stay ahead of budget issues, implement a weekly variance report that compares budgeted hours to actual hours logged [3]. Use the Estimate at Completion (EAC) formula - EAC = Actual Costs (to date) + Forecast-to-Complete - to monitor your burn rate [10] [11]. For example, if a project is 25% complete but has already consumed 50% of the budgeted hours, that’s a red flag signaling the need for a change order [3]. When a project reaches 75–80% of its budgeted hours, immediately discuss the remaining scope and potential change orders with the client [3]. This proactive approach keeps budgets in check and reduces surprises.

But even the best tracking systems won’t help if your project boundaries aren’t clear from the start.

Define Exact Project Boundaries Before Work Begins

Ambiguity about deliverables leads to over-servicing and unbilled work. Avoid this by clearly defining what’s included - and what’s excluded - before the project begins [6] [4]. Internally, hold a brief meeting to ensure budgeted hours align with the client’s documented requirements [3]. During scoping calls, use closed-loop communication: repeat the client’s requirements back to them to confirm alignment before finalizing documentation [4].

To streamline decision-making, consider the RAPID Framework, which clarifies who has authority over scope changes. Set firm defaults in your review process - for instance, if feedback isn’t provided by a set deadline, proceed with the current version to avoid unbilled delays [4]. Only a small percentage of agencies successfully deliver projects within budget, highlighting the importance of strong upfront scoping [3].

Conclusion: Protecting Your Agency from Scope Creep Losses

Scope creep doesn’t drain agency profits because clients ask for too much - it happens because founders lack financial systems that can quickly identify, price, and manage scope changes. The case studies highlighted here show a clear trend: agencies relying on post-project reviews catch the problem too late. By then, the damage to margins is already done.

The fix lies in implementing financial controls that work in real time. Tracking project variances as they happen - not after the fact - is critical. Early signs of project overages are red flags that demand immediate attention. A large portion of agencies fall prey to scope creep [1][7], but those that avoid it share one key trait: they’ve put systems in place for weekly variance tracking, formalized change order processes, and team-wide understanding of "agency math." This ensures everyone knows when a client’s request crosses the line into unprofitable territory [1].

The numbers don’t lie. Maintaining strict labor productivity discipline is essential to avoid a spiral of unbilled revisions eating away at your margins [3][7].

Rachel Gertz, Co-Founder of Louder Than Ten, sums it up perfectly: "Project management is a leading indicator in your business that tells you how healthy your people are, how solid your delivery margin is, and whether you can count on repeat client revenue six months from now" [6].

This underscores the importance of the dynamic systems discussed earlier. StealthCFO’s approach, like the 90-Day Financial Control Sprint, equips agency founders with tools for real-time financial oversight. These systems provide owner-level clarity, enforce labor discipline, and deliver rolling forecasts that adapt as project costs shift. This isn’t about generating more reports - it’s about creating safeguards that help you catch scope creep before it eats into profitability, enabling faster, smarter decisions as your agency grows.

With the right financial systems in place, scope creep becomes manageable. The real question is whether you’ll take control with systems designed to act in real time.

FAQs

What are the best ways for agencies to spot scope creep early in a project?

To stay ahead of scope creep, agencies need to regularly monitor actual hours worked, revisions made, and change requests against the initial project scope. Start with a well-defined project scope document and use real-time variance tracking to flag unplanned tasks, extra revisions, or requests that fall outside the agreed-upon scope.

By staying on top of this process, you not only protect your margins but also keep client communication clear, avoiding issues before they turn into larger conflicts.

How can agencies effectively track and manage scope changes during projects?

To keep scope changes under control, agencies can rely on a real-time project variance dashboard. This tool monitors change requests, compares planned hours and budgets against actuals, and instantly highlights any deviations. With this level of immediate insight, teams can quickly address shifts in scope and prevent unplanned expenses from spiraling out of control.

Combining this with well-defined communication protocols ensures that everyone involved stays informed and aligned when adjustments occur, minimizing the chance of financial surprises.

Why is it crucial to set clear project boundaries before starting work?

Setting clear project boundaries from the outset is crucial to maintaining profitability, staying within budget, and preserving strong client relationships. When boundaries are vague or undefined, projects can spiral beyond their original scope, leading to unnecessary challenges and inflated expectations that are difficult to manage.

By defining these limits early on, you align with clients on goals and deliverables, safeguard your team’s time and energy, and keep costs under control - all of which are essential for running a sustainable and efficient agency.

Related Blog Posts

Search for more blogs

For now, start where every serious founder does — with control.

© STEALTHCFO 2025 | TERMS & PRIVACY